UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant. | x |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

AVENUE THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

AVENUE THERAPEUTICS, INC.

1140 Avenue of the Americas, Floor 9

New York, New York 10036

Dear Stockholder:

You are cordially invited to the Annual Meeting of Stockholders (the “Annual Meeting”) of Avenue Therapeutics, Inc. (“Avenue” or the “Company”), to be held virtually at 9 a.m. local time, on Thursday, December 16, 2021. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/ATXI2021, where you will be able to listen to the meeting live, submit questions and vote online. At the Annual Meeting, the stockholders will be asked to (i) elect seven directors for a term of one year, (ii) ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2021, (iii) approve an amendment to our 2015 Equity Incentive Plan to increase the number of authorized shares issuable by 2,000,000 shares, and (iv) transact any other business that may properly come before the 2021 Annual Meeting or any adjournment of the 2021 Annual Meeting. You will also have the opportunity to ask questions and make comments at the meeting. It is important that your stock be represented at the meeting regardless of the number of shares you hold. You are encouraged to specify your voting preferences by marking our proxy card and returning it as directed. If you do virtually attend the Annual Meeting and wish to vote virtually, you may revoke your proxy at the meeting.

If you have any questions about the proxy statement or the accompanying 2020 Annual Report, please contact Joseph Vazzano, our Chief Financial Officer at (781) 652-4500.

We look forward to seeing you at the Annual Meeting.

Sincerely,

Lucy Lu, M.D.

President, Chief Executive Officer and Director

November 23, 2021

New York, New York

AVENUE THERAPEUTICS, INC.

1140 Avenue of the Americas, Floor 9

New York, New York 10036

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders of Avenue Therapeutics, Inc. can be accessed by visiting www.virtualshareholdermeeting.com/ATXI2021, on Thursday, December 16, 2021, at 9:00 a.m., local time. At the meeting, stockholders will consider and act on the following items:

| 1. | Elect seven directors for a term of one year; |

| 2. | Ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2021; |

| 3. | To approve an amendment to our 2015 Equity Incentive Plan to increase the number of authorized shares issuable by 2,000,000 shares; and |

| 4. | Transact any other business that may properly come before the Annual Meeting or any adjournment of the Annual Meeting. |

Only those stockholders of record as of the close of business on November 22, 2021, are entitled to vote at the Annual Meeting or any postponements or adjournments thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be available for your inspection beginning December 5, 2021, at our offices located at 1140 Avenue of the Americas, Floor 9, New York, New York 10036, between the hours of 10:00 a.m. and 5:00 p.m., local time, each business day during the 10 days preceding the Annual Meeting, however, if we determine that a physical in-person inspection is not practicable, such list of stockholders may be made available electronically, upon request.

YOUR VOTE IS IMPORTANT!

Submitting your proxy does not affect your right to vote virtually if you decide to virtually attend the Annual Meeting. You are urged to submit your proxy as soon as possible, regardless of whether or not you expect to virtually attend the Annual Meeting. You may revoke your proxy at any time before it is voted at the Annual Meeting by (i) delivering written notice to our Corporate Secretary, Joseph Vazzano, at our address above, (ii) submitting a later dated proxy card, or (iii) virtually attending the Annual Meeting and voting. No revocation under (i) or (ii) will be effective unless written notice or the proxy card is received by our Corporate Secretary at or before the Annual Meeting.

When you submit your proxy, you authorize Lucy Lu, M.D., and Joseph Vazzano to vote your shares at the Annual Meeting and on any adjournments of the Annual Meeting in accordance with your instructions.

By Order of the Board of Directors,

Joseph Vazzano

Corporate Secretary

November 23, 2021

New York, New York

AVENUE THERAPEUTICS, INC.

1140 Avenue of the Americas, Floor 9

New York, New York 10036

Phone: (781) 652-4500

Fax: (646) 619-4950

PROXY STATEMENT

This proxy statement is being made available via Internet access, beginning on or about November 23, 2021, to the owners of shares of common stock of Avenue Therapeutics, Inc. (the “Company,” “our,” “we,” or “Avenue”) as of November 22, 2021, in connection with the solicitation of proxies by our Board of Directors for our 2021 Annual Meeting of Stockholders (the “Annual Meeting”).

The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/ATXI2021 on Thursday, December 16, 2021, at 9:00 a.m., local time. Our Board of Directors encourages you to read this document thoroughly and take this opportunity to vote, via proxy, on the matters to be decided at the Annual Meeting. As discussed below, you may revoke your proxy at any time before your shares are voted at the Annual Meeting.

TABLE OF CONTENTS

i

ii

| Q: | What is the purpose of the Annual Meeting? |

| A. | At the Annual Meeting, our stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders accompanying this proxy statement, including (i) the election of seven directors for a term of one year, (ii) ratifying the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2021, (iii) the approval of an amendment to our 2015 Equity Incentive Plan to increase the number of authorized shares issuable by 2,000,000 shares, and (vi) transacting any other business that may properly come before the 2021 Annual Meeting or any adjournment thereof. |

| Q: | Who is entitled to vote at our Annual Meeting? |

| A. | The record holders of our common stock at the close of business on the record date, November 22, 2021, may vote at the Annual Meeting. Each share of common stock is entitled to one vote. There were 18,992,498 shares of common stock and 250,000 shares of Class A Preferred Stock outstanding on the record date and entitled to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting, including the address of and number of shares held by each stockholder of record, will be available for your inspection beginning December 5, 2021, at our offices located at 1140 Avenue of the Americas, Floor 9, New York, New York 10036, between the hours of 10:00 a.m. and 5:00 p.m., local time, each business day during the 10 days preceding the Annual Meeting, however, if we determine that a physical in-person inspection is not practicable, such list of stockholders may be made available electronically, upon request. |

Stockholders of Record: Shares Registered in Your Name. If on the Record Date your shares were registered directly in your name with our transfer agent, VStock Transfer, LLC, then you are a stockholder of record. As a stockholder of record, you may vote virtually at the Annual Meeting or vote by proxy. Whether or not you plan to virtually attend the Annual Meeting, we urge you to fill out and return the enclosed proxy card, to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank, Custodian or Other Nominee. If on the Record Date your shares were held in an account at a brokerage firm, bank, custodian or other nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank, custodian or other nominee on how to vote the shares in your account. You are also invited to virtually attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from your broker, bank, custodian or other nominee.

| Q: | How do I vote? |

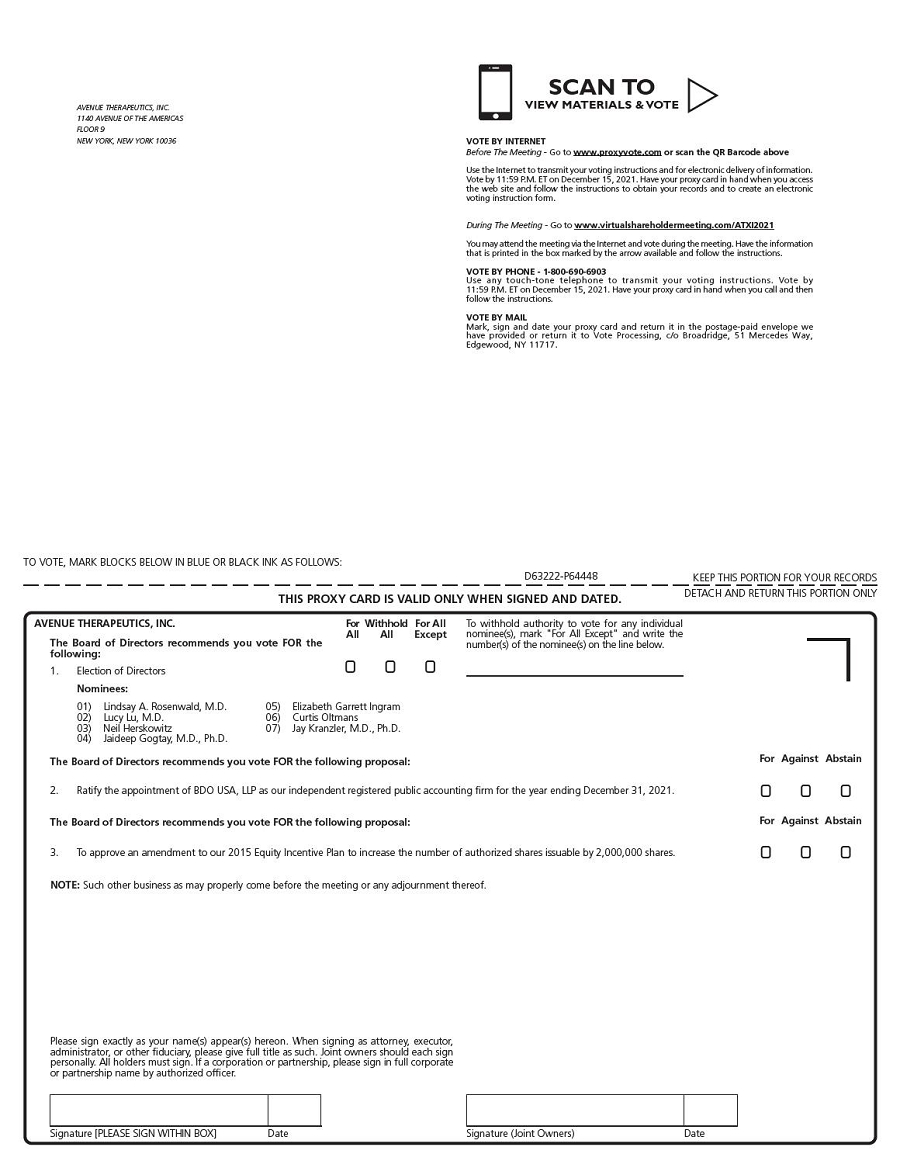

| A. | You may vote during the Annual Meeting by following the instructions posted at www.proxyvote.com and entering your 16-digit control number included with the Notice of Internet Availability or proxy card, by use of a proxy card if you receive a printed copy of our proxy materials, via internet as directed in our “Important Notice Regarding the Availability of Proxy Materials,” or by telephone as indicated in the proxy card. |

1

Whether you hold shares directly as the stockholder of record or indirectly as the beneficial owner of shares held for you by a broker or other nominee (i.e., in “street name”), you may direct your vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares you hold in street name, by submitting voting instructions to your broker or nominee. In most instances, you will be able to do this by internet, telephone or by mail. Please refer to the summary instructions below and those included on your proxy card or, for shares you hold in street name, the voting instruction card provided by your broker or nominee.

| · | By Internet - If you have Internet access, you may authorize your proxy from any location in the world as directed in our “Important Notice Regarding the Availability of Proxy Materials.” |

| · | By Telephone - If you are calling from the United States or Canada, you may authorize your proxy by following the “By Telephone” instructions on the proxy card or, if applicable, the telephone voting instructions that may be described on the voting instruction card sent to you by your broker or nominee. |

| · | By Mail - You may authorize your proxy by signing your proxy card and mailing it in the enclosed, postage-prepaid and addressed envelope. For shares you hold in street name, you may sign the voting instruction card included by your broker or nominee and mail it in the envelope provided. |

| Q: | What if I have technical difficulties or trouble accessing the virtual Annual Meeting? |

| A. | We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number located on the meeting page. Technical support will be available starting at approximately 8:45 a.m., local time, on December 16, 2021. |

| Q: | What is a proxy? |

| A. | A proxy is a person you appoint to vote your shares on your behalf. If you are unable to virtually attend the Annual Meeting, our Board of Directors is seeking your appointment of a proxy so that your shares may be voted. If you vote by proxy, you will be designating Lucy Lu, M.D., our President and Chief Executive Officer, and Joseph Vazzano, our Chief Financial Officer, as your proxies. Dr. Lu and/or Mr. Vazzano may act on your behalf and have the authority to appoint a substitute to act as your proxy. |

| Q: | How will my shares be voted if I vote by proxy? |

| A. | Your proxy will be voted according to the instructions you provide. If you complete and submit your proxy but do not otherwise provide instructions on how to vote your shares, your shares will be voted (i) “FOR” the individuals nominated to serve as members of our Board of Directors, (ii) “FOR” the ratification of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2021, and (iii) “FOR” the approval of an amendment to our 2015 Equity Incentive Plan to increase the number of authorized shares issuable by 2,000,00 shares. Presently, our Board does not know of any other matter that may come before the Annual Meeting. However, your proxies are authorized to vote on your behalf, using their discretion, on any other business that properly comes before the Annual Meeting. |

2

| Q: | How do I revoke my proxy? |

| A. | You may revoke your proxy at any time before your shares are voted at the Annual Meeting by: |

| · | You may send a written notice that you are revoking your proxy to our Corporate Secretary, Joseph Vazzano, at our address above (so long as we receive such notice no later than the close of business on the day before the Annual Meeting); |

| · | You may submit a later dated proxy card or voting again via the internet as described in the “Important Notice Regarding the Availability of Proxy Materials”; or |

| · | You may virtually attend the Annual Meeting and notify the election officials at the Annual Meeting that you wish to revoke your proxy and vote virtually. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker, bank, custodian or other nominee, you should follow the instructions provided by such broker, bank, custodian or other nominee.

| Q: | Is my vote confidential? |

| A. | Yes. All votes remain confidential. |

| Q: | How are votes counted? |

| A. | Before the Annual Meeting, our Board of Directors will appoint one or more inspectors of election for the meeting. The inspector(s) will determine the number of shares represented at the meeting, the existence of a quorum and the validity and effect of proxies. The inspector(s) will also receive, count, and tabulate ballots and votes and determine the results of the voting on each matter that comes before the Annual Meeting. |

Abstentions and votes withheld, and shares represented by proxies reflecting abstentions or votes withheld, will be treated as present for purposes of determining the existence of a quorum at the Annual Meeting. They will not be considered as votes “for” or “against” any matter for which the stockholder has indicated their intention to abstain or withhold their vote. Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Pursuant to the New York Stock Exchange (the “NYSE”), which govern voting matters at the Annual Meeting, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner.

3

The following matter up for vote at the Annual Meeting is considered to be “routine”: the ratification of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2021.

| Q: | What constitutes a quorum at the Annual Meeting? |

| A. | In accordance with Delaware law (the law under which we are incorporated) and our Amended and Restated Bylaws (“Bylaws”), the presence at the Annual Meeting, by proxy or in person, of the holders of a majority of the outstanding shares of the capital stock entitled to vote at the Annual Meeting constitutes a quorum, thereby permitting the stockholders to conduct business at the Annual Meeting. Abstentions, votes withheld, and broker or nominee non-votes will be included in the calculation of the number of shares considered present at the Annual Meeting for purposes of determining the existence of a quorum. |

If a quorum is not present at the Annual Meeting, a majority of the stockholders present and by proxy may adjourn the meeting to another date. If an adjournment is for more than 30 days or a new record date is fixed for the adjourned meeting by our Board, we will provide notice of the adjourned meeting to each stockholder of record entitled to vote at the adjourned meeting. At any adjourned meeting at which a quorum is present, any business may be transacted that might have been transacted at the originally called meeting.

| Q: | What vote is required to elect our directors for a one-year term? |

| A. | The affirmative vote of a plurality of the votes of the shares present or by proxy, at the Annual Meeting is required for the election of each of the nominees for director. “Plurality” means that the nominees receiving the largest number of votes up to the number of directors to be elected at the Annual Meeting will be duly elected as directors. Abstentions, votes withheld, and broker or nominee non-votes will not affect the outcome of director elections; provided, however, our Class A Preferred Stock has the right to elect a majority of our directors. |

| Q: | What vote is required to ratify BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2021? |

| A. | The affirmative vote of a majority of the shares present or by proxy, and entitled to vote at the Annual Meeting is required to approve the ratification of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2021. Abstentions and votes withheld will have the same effect as a negative vote. However, broker or nominee non-votes, and shares represented by proxies reflecting broker or nominee non-votes, will not have the effect of a vote against this proposal as they are not considered to be present and entitled to vote on this matter. |

4

| Q: | What vote is required to approve the amendment to our 2015 Equity Incentive Plan to increase the number of authorized shares by 2,000,000 shares? |

| A. | The affirmative vote of a majority of the shares present, in person or by proxy, and entitled to vote at the Annual Meeting is required to approve an amendment to our 2015 Equity Incentive Plan to increase the number of authorized shares issuable thereunder by 2,000,000 shares. Abstentions and votes withheld will have the same effect as a negative vote. However, broker or nominee non-votes, and shares represented by proxies reflecting broker or nominee non-votes, will not have the effect of a vote against this proposal as they are not considered to be present and entitled to vote on this matter. |

| Q: | What percentage of our outstanding common stock do our directors, executive officers, and 5% beneficial owners own? |

| A. | As of November 22, 2021, our directors, executive officers, and 5% beneficial owners owned, or have the right to acquire, approximately 58% of our outstanding common stock and 100% of our Class A Preferred Stock. See the discussion under the heading “Stock Ownership of Our Directors, Executive Officers, and 5% Beneficial Owners” on page 25 for more details. |

| Q: | Who was our independent public accountant for the year ended December 31, 2020? Will they be represented at the Annual Meeting? |

| A. | BDO USA, LLP is the independent registered public accounting firm that audited our financial statements for the year ended December 31, 2020. We expect a representative of BDO USA, LLP to be present virtually at the Annual Meeting. The representative will have an opportunity to make a statement and will be available to answer your questions. |

| Q: | How can I obtain a copy of our Annual Report on Form 10-K? |

| A. | We have filed our Annual Report on Form 10-K for the year ended December 31, 2020, with the SEC. The annual report on Form 10-K is also included in the 2020 Annual Report to Stockholders. You may obtain, free of charge, a copy of our Annual Report on Form 10-K, including financial statements, by writing to our Corporate Secretary, Joseph Vazzano, or by email at info@avenuetx.com. Upon request, we will also furnish any exhibits to the Annual Report on Form 10-K as filed with the SEC. |

5

Our Bylaws provide that our Board shall consist of between one to nine directors, and such number of directors within this range may be determined from time to time by resolution of our board of directors or our stockholders. Our current Bylaws indicate that the size of our Board may only be increased or decreased upon consent of InvaGen Pharmaceuticals Inc. (“InvaGen”), as part of, and in accordance with, the agreement we entered into with InvaGen and certain stockholders on November 12, 2018. Currently, we have seven directors. The following individuals are being nominated to serve on our Board (See “Proposal 1 — Election of Directors; Nominees”):

| Name | Age | Position | Director Since | |||

| Lindsay A. Rosenwald, M.D. | 66 | Executive Chairman of the Board of Directors | 2015 | |||

| Lucy Lu, M.D. | 46 | President, Chief Executive Officer, and Director | 2015 | |||

| Neil Herskowitz | 64 | Director | 2015 | |||

| Jay Kranzler, M.D., PhD | 63 | Director | 2017 | |||

| Curtis Oltmans | 58 | Director | 2021 | |||

| Elizabeth Garrett Ingram | 56 | Director | 2019 | |||

| Jaideep Gogtay, M.D. | 55 | Director | 2019 |

The Board does not have a formal policy regarding the separation of the roles of Chief Executive Officer and Chairman, as the Board believes that it is in the best interests of the Company to make that determination based on the direction of the Company and the current membership of the Board. The Board has determined that at present having Dr. Rosenwald serve as Executive Chairman is in the best interest of the Company’s stockholders.

Avenue has a risk management program overseen by Lucy Lu, M.D., our President and Chief Executive Officer, and the Board. Dr. Lu and management identify material risks and prioritize them for our Board. Our Board regularly reviews information regarding our credit, liquidity, operations, and compliance as well as the risks associated with each.

The following biographies set forth the names of our directors and director nominees, their ages, the year in which they first became directors, their positions with us, their principal occupations and employers for at least the past five years, any other directorships held by them during the past five years in companies that are subject to the reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), or any company registered as an investment company under the Investment Company Act of 1940, as well as additional information, all of which we believe sets forth each director nominee’s qualifications to serve on the Board. There is no family relationship between and among any of our executive officers or directors. On November 12, 2018, we entered into a Stock Purchase and Merger Agreement (the “SPMA”) with InvaGen and Madison Pharmaceuticals Inc., pursuant to which InvaGen purchased common stock representing 33.3% of the Company for $35 million. In connection with the execution and delivery of the SPMA, and as described above, we entered into a Stockholders Agreement pursuant to which, among other things, InvaGen obtained the right to nominate three directors to the Company’s seven member Board. In 2019, InvaGen exercised its right to nominate Dr. Gogtay and Ms. Ingram to the Company’s Board. Additionally, in April 2021, InvaGen exercised its right to nominate a third director, Mr. Oltmans. Even though the Company terminated the SPMA on November 1, 2021, InvaGen still retains its right to have three members on the Company’s Board pursuant to the Stockholders Agreement. Except as described herein, there are no arrangements or understandings between any of our executive officers or directors and any other person pursuant to which any of them are elected as an officer or director.

6

Director Independence and Controlled Company Exemption

Avenue adheres to the corporate governance standards adopted by The Nasdaq Stock Market (“Nasdaq”). Nasdaq rules require our Board to make an affirmative determination as to the independence of each director. Consistent with these rules, our Board undertook its annual review of director independence on November 22, 2021. During the review, our Board considered relationships and transactions during 2020 and since inception between each director or any member of his or her immediate family, on the one hand, and the Company and our subsidiaries and affiliates, on the other hand. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent. Based on this review, our Board determined that Neil Herskowitz, Jay Kranzler, M.D., and Curtis Oltmans are independent under the criteria established by Nasdaq and our Board.

Fortress Biotech, Inc. (“Fortress”) beneficially owns common stock representing more than 50% of the voting power of our Common Stock eligible to vote in the election of directors. As a result, we qualify as a “controlled company” and avail ourselves of certain “controlled company” exemptions under the Nasdaq corporate governance rules. As a controlled company, we are not required to have a majority of “independent directors” on our Board as defined under the Nasdaq rules, or have a compensation, nominating or governance committee composed entirely of independent directors. In light of our status as a controlled company, our Board has determined to utilize the majority board independence exemption.

Lindsay A. Rosenwald, M.D. — Executive Chairman of the Board of Directors

Dr. Rosenwald, 66, has served as our Executive Chairman of the Board of Directors since inception. Dr. Rosenwald also serves as Chairman, President and Chief Executive Officer of Fortress Biotech, Inc., Chairman of Journey Medical Corporation, a director of Mustang Bio, Inc., and a director of Checkpoint Therapeutics, Inc. Since November 2008, Dr. Rosenwald has served as Co-Portfolio Manager and Partner of Opus Point Partners Management, LLC (“Opus Point”), an asset management firm in the life sciences industry, which he joined in 2009. Prior to that, from 1991 to 2008, he served as the Chairman of Paramount BioCapital, Inc. The Board believes that because Dr. Rosenwald, over the last 23 years, has acted as a biotechnology entrepreneur and has been involved in the founding and recapitalization of numerous public and private biotechnology and life sciences companies, he is exceptionally qualified to serve on our Board as Executive Chairman. Dr. Rosenwald received his B.S. in finance from Pennsylvania State University and his M.D. from Temple University School of Medicine.

Lucy Lu, M.D. — President, Chief Executive Officer, and Director

Dr. Lu, 46, has been our President and Chief Executive Officer since inception. From February 2012 to June 2017, Dr. Lu was the Executive Vice President and Chief Financial Officer of Fortress Biotech, Inc. Prior to working in the biotech industry, Dr. Lu had 10 years of experience in healthcare-related equity research and investment banking. Additionally, Dr. Lu was a member of the Board of Directors of Veru, Inc. from 2016 to 2018, and has served as a member of the Board of Directors of Iventia Healthcare Limited since 2018. From February 2007 through January 2012, Dr. Lu was a senior biotechnology equity analyst with Citigroup Investment Research. From 2004 until joining Citigroup, she was with First Albany Capital, serving as Vice President from April 2004 until becoming a Principal of the firm in February 2006. Dr. Lu holds an M.D. degree from the New York University School of Medicine and an M.B.A. from the Leonard N. Stern School of Business at New York University. Dr. Lu obtained a B.A. from the University of Tennessee’s College of Arts and Science. We believe that Dr. Lu is qualified to serve on our Board due to her leadership and management experience, her understanding of biopharmaceutical companies, and her extensive knowledge of our business and industry.

7

Neil Herskowitz

Mr. Herskowitz, 64, joined our Board of Directors in August 2015 and has served as the Chairman of our Audit Committee since September 2016. Mr. Herskowitz has served as the managing member of the ReGen Group of companies, located in New York, since 1998, which include ReGen Capital Investments LLC and Riverside Claims Investments LLC. He has also served as the President of its affiliate, Riverside Claims LLC, since June 2004. Additionally, Mr. Herskowitz served as a Board member of National Holdings, Inc. from 2016 to 2019, and has served as a Board member of Mustang Bio, Inc., Journey Medical Corporation and Checkpoint Therapeutics, Inc. since 2015. Mr. Herskowitz received a B.B.A. in Finance from Bernard M. Baruch College in 1978. The Board believes, based on Mr. Herskowitz’s over 15 years of Audit Committee and Board experience in the biotech industry, that Mr. Herskowitz is uniquely qualified to serve as a member of our Board and as the Chairman of our Audit Committee.

Jay Kranzler, M.D., PhD

Dr. Kranzler, 63, joined our Board of Directors in February 2017. Dr. Kranzler has been a Founder, Chief Executive Officer, Board Member, and Advisor to leading life science companies for over 30 years. He is currently acting as Executive Chairman of Perception Neuroscience, a company that he co-founded, a regenerative medicine company, and is a Board Member of Pastorus and ImmunoBrain Checkpoint, all companies focused on developing therapeutics for psychiatric or neurological disorders. Dr. Kranzler started his career at McKinsey & Company where he helped establish the Firm’s pharmaceutical practice. He served as CEO of Cytel Corporation, a company focused on the development of immunomodulatory drugs. Following Cytel, Dr. Kranzler became the CEO of Cypress Bioscience, where he was credited for the development of Savella™ (milnacipran) for the treatment of fibromyalgia. Dr. Kranzler was also Vice President, Head of Worldwide External R&D Innovation and Strategic Investments at Pfizer. During his career, Dr. Kranzler has developed drugs, medical devices, as well as diagnostics, and is the inventor on over 30 patents. Dr. Kranzler graduated from Yale University School of Medicine with MD and PhD degrees with a focus in psychopharmacology. We believe that Dr. Kranzler is qualified to serve on our Board due to his management experience, his service as an executive of biopharmaceutical companies and his knowledge of our business and industry.

Curtis Oltmans

Mr. Oltmans, 58, joined our Board of Directors in April 2021 and is currently General Counsel of Fulcrum Therapeutics, Inc. and has over 25 years of experience in corporate law including senior management positions in legal departments at several leading pharmaceutical and biotechnology companies. Prior to Fulcrum Therapeutics, Inc, he served as Vice President, Head of Litigation at DaVita Kidney Care, Inc. where he led a 30-person team and was responsible for all litigation, workers’ compensation and employee safety matters. Prior to DaVita Kidney Care, Mr. Oltmans was Executive Vice President, General Counsel and Corporate Secretary at Array BioPharma, Inc., where he oversaw all legal, corporate governance, patent and compliance matters. He previously served as Corporate Vice President and General Counsel for Novo Nordisk, Inc., North America. He was responsible for strategic support in areas including market access, government affairs, communications and product marketing. He has also served as Assistant General Counsel for Eli Lilly and Company after beginning his legal career supporting clients in pharmaceutical and medical device litigation matters. He served on the Board of Trustees for the Mercer County Boy’s and Girl’s Club. Mr. Oltmans received a B.A. in political science from the University of Nebraska and his J.D. from the University of Nebraska College of Law. Based on Mr. Oltmans’ pharmaceutical industry experience, the Board believes that Mr. Oltmans has the appropriate set of skills to serve as a member of the Board.

8

Jaideep Gogtay, M.D.

Dr. Gogtay, 55, joined our Board of Directors in February 2019. Since 1994, he has been working with Cipla Ltd., a leading global pharmaceutical company, and he currently serves as their Global Chief Medical Officer. He has closely been involved in the development and introduction of several drugs in various therapeutic fields. He was involved in setting up the Chest Research Foundation. This Foundation is now an independent research center dedicated to conducting research in the field of respiratory medicine. He has participated and spoken at several national and international forums, and has been actively involved in educational activities. Dr. Gogtay completed his medical graduation (M.B., B.S) from Grant Medical College and SirJJ Group of Hospitals in Mumbai. He then obtained his M.D, in Pharmacology from Seth GS Medical College and KEM Hospital. Based on Dr. Gogtay’s pharmaceutical industry experience, the Board believes that Dr. Gogtay has the appropriate set of skills to serve as a member of the Board.

Elizabeth Garrett Ingram

Ms. Ingram, 56, has served as a member of our Board of Directors since August 2019. She currently serves as the Chief Commercial Officer at Cipla Therapeutics, Inc. Prior to her new role at Cipla Therapeutics, Inc., Ms. Ingram served as Chief Marketing Officer at MannKind Corporation, based in California. In addition, she has served in roles as Senior Vice President, Managed Markets at Dexcom and Vice President, Head of Market Access at Sanofi, where she had responsibility across four of the U.S. Business Units: Diabetes & Cardiovascular, General Medicines, Sanofi Genzyme Specialty Care, and Sanofi Pasteur from 2014 to 2016. Prior to joining Sanofi, she held the position of Vice President of Market Access Strategy at Bristol Myers Squibb, where she led the access, reimbursement, patient affordability and emerging customer strategy teams across the portfolio of diabetes, RA, cardiovascular, oncology, immunology, neuroscience and pipeline assets. Ms. Ingram holds a Bachelor of Science degree from East Carolina University, a Master’s Degree in public health and community education from the University of South Carolina and has completed multiple post graduate studies at Wharton School of Business.

During 2020, our Board held eight meetings and took one action by unanimous written consent. During 2020 each incumbent director who served their full term and are standing for election attended the meeting of the Board of Directors and the meetings of those committees on which each incumbent director served, in each case during the period that such person was a director. The permanent committees established by our Board of Directors are the Audit Committee and the Compensation Committee, descriptions of which are set forth in more detail below. Our directors are expected to attend each Annual Meeting of Stockholders, and it is our expectation that all of the directors standing for election will attend this year’s Annual Meeting. This will be our fourth Annual Meeting of Stockholders since we became a public reporting company in June 2017.

Communicating with the Board of Directors

Our Board has established a process by which stockholders can send communications to the Board. You may communicate with the Board as a group, or to specific directors, by writing to Joseph Vazzano, our Corporate Secretary, at our offices located at 1140 Avenue of the Americas, Floor 9, New York, NY 10036. The Corporate Secretary will review all such correspondence and regularly forward to our Board a summary of all correspondence and copies of all correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board or committees thereof or that he otherwise determines requires their attention. Directors may at any time review a log of all correspondence we receive that is addressed to members of our Board and request copies of any such correspondence. Concerns relating to accounting, internal controls, or auditing matters may be communicated in this manner, or may be submitted on an anonymous basis via e-mail at BOD@avenuetx.com. These concerns will be immediately brought to the attention of our Board and handled in accordance with procedures established by our Board.

9

The Audit Committee currently consists of Neil Herskowitz, Curtis Oltmans, and Jay Kranzler, M.D., PhD. Mr. Herskowitz serves as the Chairperson of the Audit Committee.

The Audit Committee was formed on May 15, 2017 and held four meetings during the fiscal year ended December 31, 2020. The duties and responsibilities of the Audit Committee are set forth in the Charter of the Audit Committee which was recently reviewed by our Audit Committee. Our Audit Committee determined that no revisions needed to be made to the charter at this time. A copy of the Charter of the Audit Committee is available on our website, located at www.avenuetx.com. Among other matters, the duties and responsibilities of the Audit Committee include reviewing and monitoring our financial statements and internal accounting procedures, the selection of our independent registered public accounting firm and consulting with and reviewing the services provided by our independent registered public accounting firm. Our Audit Committee has sole discretion over the retention, compensation, evaluation and oversight of our independent registered public accounting firm.

The SEC and Nasdaq have established rules and regulations regarding the composition of audit committees and the qualifications of audit committee members. Our Board of Directors has examined the composition of our Audit Committee and the qualifications of our Audit Committee members in light of the current rules and regulations governing audit committees. Based upon this examination, our Board of Directors has determined that each member of our Audit Committee is independent and is otherwise qualified to be a member of our Audit Committee in accordance with the rules of the SEC and Nasdaq.

Additionally, the SEC requires that at least one member of the Audit Committee have a “heightened” level of financial and accounting sophistication. Such a person is known as the “audit committee financial expert” under the SEC’s rules. Our Board has determined that Neil Herskowitz is an “audit committee financial expert,” as the SEC defines that term, and is an independent member of our Board of Directors and our Audit Committee. Please see Neil Herskowitz’s biography on page 8 for a description of his relevant experience.

The report of the Audit Committee can be found on page 14 of this proxy statement.

10

The Compensation Committee was formed on May 15, 2017. The Compensation Committee did not hold any meetings during the fiscal year ended December 31, 2020 but took action by two unanimous written consents. The Compensation Committee currently consists of Jay Kranzler, M.D. PhD, Neil Herskowitz and Curtis Oltmans, with Dr. Kranzler serving as Chairman. The duties and responsibilities of the Compensation Committee are set forth in the Charter of the Compensation Committee. A copy of the Charter of the Compensation Committee is available on our website, located at www.avenuetx.com. As discussed in its charter, among other things, the duties and responsibilities of the Compensation Committee include annually reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer, reviewing and approving, or making recommendations to our Board of Directors with respect to, the compensation of our Chief Executive Officer and our other executive officers, overseeing an the evaluation of our senior executives, and overseeing and administering our cash and equity incentive plans. The Compensation Committee applies discretion in the determination of individual executive compensation packages to ensure compliance with the Company’s compensation philosophy. The Chief Executive Officer makes recommendations to the Compensation Committee with respect to the compensation packages for officers other than herself. The Compensation Committee may delegate its authority to grant awards to certain employees, and within specified parameters under the Avenue Therapeutics, Inc. 2015 Incentive Plan (the “2015 Incentive Plan”), to a special committee consisting of one or more directors who may but need not be officers of the Company. As of November 22, 2021, however, the Compensation Committee had not delegated any such authority. The Board may engage a compensation consultant to conduct a review of its executive compensation programs in 2021. The Committee did not engage a compensation consultant in 2020.

Nasdaq has established rules and regulations regarding the composition of compensation committees and the qualifications of compensation committee members. As a controlled company, we are not required to have a compensation committee composed entirely of independent directors. However, our Board of Directors has examined the composition of our Compensation Committee and the qualifications of our Compensation Committee members in light of the current rules and regulations governing compensation committees. Based upon this examination, our Board of Directors has determined that each member of our Compensation Committee is independent and is otherwise qualified to be a member of our Compensation Committee in accordance with such rules.

We do not currently have a nominating committee or any other committee serving a similar function. Director nominations are approved by a vote of a majority of our independent directors as required under the Nasdaq rules and regulations. Although we do not have a written charter in place to select director nominees, our Board of Directors has adopted resolutions regarding the director nomination process. We believe that the current process in place functions effectively to select director nominees who will be valuable members of our Board of Directors.

We identify potential nominees to serve as directors through a variety of business contacts, including current executive officers, directors, community leaders and stockholders. We may, to the extent they deem appropriate, retain a professional search firm and other advisors to identify potential nominees.

We will also consider candidates recommended by stockholders for nomination to our Board. A stockholder who wishes to recommend a candidate for nomination to our Board must submit such recommendation to our Corporate Secretary, Joseph Vazzano, at our offices located at 1140 Avenue of the Americas, Floor 9, New York, New York 10036. Any recommendation must be received not less than 50 calendar days nor more than 90 calendar days before the anniversary date of the previous year’s annual meeting. All stockholder recommendations of candidates for nomination for election to our Board must be in writing and must set forth the following: (i) the candidate’s name, age, business address, and other contact information, (ii) the number of shares of common stock beneficially owned by the candidate, (iii) a complete description of the candidate’s qualifications, experience, background and affiliations, as would be required to be disclosed in the proxy statement pursuant to Schedule 14A under the Exchange Act, (iv) a sworn or certified statement by the candidate in which he or she consents to being named in the proxy statement as a nominee and to serve as director if elected, and (v) the name and address of the stockholder(s) of record making such a recommendation.

11

We believe that our Board as a whole should encompass a range of talent, skill, and expertise enabling it to provide sound guidance with respect to our operations and interests. Our independent directors evaluate all candidates to our Board by reviewing their biographical information and qualifications. If the independent directors determine that a candidate is qualified to serve on our Board, such candidate is interviewed by at least one of the independent directors and our Chief Executive Officer. Other members of the Board also have an opportunity to interview qualified candidates. The independent directors then determine, based on the background information and the information obtained in the interviews, whether to recommend to the Board that the candidate be nominated for approval by the stockholders to fill a directorship. With respect to an incumbent director whom the independent directors are considering as a potential nominee for re-election, the independent directors review and consider the incumbent director’s service during his or her term, including the number of meetings attended, level of participation, and overall contribution to the Board. The manner in which the independent directors evaluate a potential nominee will not differ based on whether the candidate is recommended by our directors or stockholders.

We consider the following qualifications, among others, when making a determination as to whether a person should be nominated to our Board: the independence of the director nominee; the nominee’s character and integrity; financial literacy; level of education and business experience, including experience relating to biopharmaceutical companies; whether the nominee has sufficient time to devote to our Board; and the nominee’s commitment to represent the long-term interests of our stockholders. We review candidates in the context of the current composition of the Board and the evolving needs of our business. We believe that each of the current members of our Board (who are also our director nominees) has the requisite business, biopharmaceutical, financial or managerial experience to serve as a member of the Board, as described above in their biographies under the heading “Our Board of Directors.” We also believe that each of the current members of our Board has other key attributes that are important to an effective board, including integrity, high ethical standards, sound judgment, analytical skills, and the commitment to devote significant time and energy to service on the Board and its committees.

We do not have a formal policy in place with regard to diversity in considering candidates for our Board, but the Board strives to nominate candidates with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee our business.

Code of Business Conduct and Ethics

We have adopted a Code of Ethics, or the Code, which applies to all of our directors and employees, including our principal executive officer and principal financial officer. The Code includes guidelines dealing with the ethical handling of conflicts of interest, compliance with federal and state laws, financial reporting, and our proprietary information. The Code also contains procedures for dealing with and reporting violations of the Code. We have posted our Code on our website, located at www.avenuetx.com.

12

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND OTHER MATTERS

BDO USA, LLP, (“BDO”) the independent registered public accounting firm that audited our financial statements for the years ended December 31, 2020 and 2019 has served as our independent registered public accounting firm since 2016. We expect a representative of BDO to be present at the Annual Meeting. The representative will have an opportunity to make a statement and will be available to answer your questions.

Our Board has asked the stockholders to ratify the selection of BDO as our independent registered public accounting firm for the year ending December 31, 2021. See “Proposal Two: Ratification of Appointment of BDO USA, LLP as Our Independent Registered Public Accounting Firm” on page 28 of this proxy statement. The Board has reviewed the fees described below and concluded that the payment of such fees is compatible with maintaining BDO’s independence. All proposed engagements of BDO, whether for audit services, audit-related services, tax services, or permissible non-audit services, were pre-approved by our Audit Committee.

For the fiscal years ended December 31, 2020 and 2019, BDO billed us an aggregate of $158,300 and $181,150 respectively, in fees for the professional services rendered in connection with the audit of our annual financial statements included in our Annual Report on Form 10-K for those two fiscal years, the review of our financial statements included in our Quarterly Reports on Form 10-Q during those two fiscal years, and other services provided in connection with registration statements.

During the fiscal years ended December 31, 2020 and 2019, we were not billed by BDO for any fees for audit-related services reasonably related to the performance of the audits and reviews for those two fiscal years, in addition to the fees described above under the heading “Audit Fees.”

During the fiscal years ended December 31, 2020 and 2019, we were not billed by BDO for any fees for professional services rendered for tax compliance, tax advice, and tax planning services.

During the fiscal years ended December 31, 2020 and 2019, we were not billed by BDO for any fees for services, other than those described above, rendered to us for those two fiscal years.

Our Audit Committee has established a policy setting forth the procedures under which services provided by our independent registered public accounting firm will be pre-approved by our Audit Committee. The potential services that might be provided by our independent registered public accounting firm fall into two categories:

| · | Services that are permitted, including the audit of our annual financial statements, the review of our quarterly financial statements, related attestations, benefit plan audits and similar audit reports, financial and other due diligence on acquisitions, and federal, state, and non-US tax services; and |

| · | Services that may be permitted, subject to individual pre-approval, including compliance and internal-control reviews, indirect tax services such as transfer pricing and customs and duties, and forensic auditing. |

Services that our independent registered public accounting firm may not legally provide include such services as bookkeeping, certain human resources services, internal audit outsourcing, and investment or investment banking advice.

All proposed engagements of our independent registered public accounting firm, whether for audit services or permissible non-audit services, are pre-approved by the Audit Committee. We jointly prepare a schedule with our independent registered public accounting firm that outlines services which we reasonably expect we will need from our independent registered public accounting firm, and categorize them according to the classifications described above. Each service identified is reviewed and approved or rejected by the Audit Committee.

13

In monitoring the preparation of our financial statements, the Audit Committee met with both management and BDO USA, LLP, (“BDO”) our independent registered public accounting firm for the year ended December 31, 2020, to review and discuss all financial statements prior to their issuance and to discuss any and all significant accounting issues. Management and our independent registered public accounting firm advised the Audit Committee that each of the financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee’s review included a discussion of the matters required to be discussed pursuant to Public Company Accounting Oversight Board (United States) Auditing Standard 1301 (Communication with Audit Committees). Auditing Standard 1301 requires our independent registered public accounting firm to discuss with the Audit Committee, among other things, the following:

| · | Methods used to account for significant or unusual transactions; |

| · | The effect of any accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| · | The process used by management to formulate sensitive accounting estimates and the basis for the independent registered public accounting firm’s conclusion regarding the reasonableness of any such estimates; and |

| · | Any disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures necessary in the financial statements. |

The Audit Committee has discussed the independence of BDO, our independent registered public accounting firm for the year ended December 31, 2020, including the written disclosures made by BDO to the Audit Committee, as required by PCAOB Rule 3526, “Communication with Audit Committees Concerning Independence.” PCAOB Rule 3526 requires the independent registered public accounting firm to (i) disclose in writing all relationships that, in the independent registered public accounting firm’s professional opinion, may reasonably be thought to bear on independence, (ii) confirm their perceived independence, and (iii) engage in a discussion of independence with the Audit Committee.

Finally, the Audit Committee continues to monitor the scope and adequacy of our internal controls and other procedures, including any and all proposals for adequate staffing and for strengthening internal procedures and controls where appropriate and necessary.

On the basis of these reviews and discussions, the Audit Committee recommended to the Board that it approve the inclusion of our audited financial statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, for filing with the SEC.

The Audit Committee reviewed its written charter previously adopted by our Board of Directors. Following this review, the Audit Committee determined that no changes needed to be made with respect to the Audit Committee charter at this time.

| By the Audit Committee | |

| Neil Herskowitz | |

| Curtis Oltmans | |

| Jay Kranzler, M.D., PhD | |

| Dated November 23, 2021 |

14

Our current executive officers are as follows:

| Name | Age | Position | |||

| Lucy Lu, M.D. | 46 | President, Chief Executive Officer and Director | |||

| Joseph Vazzano | 37 | Chief Financial Officer and Principal Financial Officer |

No executive officer is related by blood, marriage or adoption to any other director or executive officer. To read more about Dr. Lu, please see page 7 of this Proxy Statement.

Joseph Vazzano — Chief Financial Officer and Principal Financial Officer

Mr. Vazzano joined the Company in August 2017 as our Vice President of Finance and Corporate Controller. Effective February 8, 2019, the Board appointed Mr. Vazzano as the Company’s Chief Financial Officer. Prior to joining Avenue, Mr. Vazzano served as Assistant Corporate Controller at Intercept Pharmaceuticals, Inc., a publicly-traded biotechnology company, which he joined in 2016. While at Intercept, Mr. Vazzano helped grow the finance and accounting department during Intercept’s transition from a development-stage company to a fully integrated commercial organization. Prior to joining Intercept, Mr. Vazzano served as the Assistant Controller at Pernix Therapeutics, a publicly-traded specialty pharmaceutical company, where he successfully built an accounting and finance team after the closure of the South Carolina office location. From 2010 to 2015, he held various roles of increasing responsibility in finance and accounting at NPS Pharmaceuticals, a publicly-traded biotechnology company acquired by Shire Pharmaceuticals in 2015. He began his professional career with KPMG, LLP, where he served as a senior auditor. Mr. Vazzano has a Bachelor of Science degree in Accounting from Lehigh University and is a Certified Public Accountant in the State of New Jersey.

15

As an emerging growth company, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. These include, but are not limited to, reduced disclosure obligations regarding executive compensation in our proxy statements, including the requirement to include a Compensation Discussion and Analysis, as well as an exemption from the requirement to hold a non-binding advisory vote on executive compensation. We have elected to comply with the scaled disclosure requirements applicable to emerging growth companies. As an emerging growth company, we are permitted to limit reporting of compensation disclosure to our principal executive officer and our two other most highly compensated executive officers, which we refer to as our “named executive officers” or our “NEOs”.

The following table sets forth information concerning compensation paid by us to our NEOs for their services rendered to us in all capacities during the years ended December 31, 2020 and 2019:

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($)(1) | Total ($) | |||||||||||||||||||||

| Lucy Lu | 2020 | 431,627 | — | — | — | 11,400 | 442,827 | |||||||||||||||||||||

| Chief Executive Officer | 2019 | 419,055 | — | — | 209,528 | 11,400 | 639,783 | |||||||||||||||||||||

| Joseph Vazzano | 2020 | 206,000 | — | — | — | 8,890 | 214,890 | |||||||||||||||||||||

| Chief Financial Officer | 2019 | 198,113 | — | — | 50,000 | 10,666 | 258,779 | |||||||||||||||||||||

| (1) | Reflects 401(k) company contributions. |

Narrative to Summary Compensation Table

Employment Agreement with Dr. Lu

On June 10, 2015, we entered into an Employment Agreement with Lucy Lu, M.D. to serve as our Interim President and Chief Executive Officer upon the completion of our initial public offering at an annualized salary of $395,000. Dr. Lu’s Employment Agreement became effective on June 26, 2017, and she became our President and Chief Executive Officer. Dr. Lu’s salary for 2020 and 2019 was $431,627 and $419,055, respectively. Under the terms of Dr. Lu’s Employment Agreement, Dr. Lu’s base salary may be reduced only in connection with a company-wide decrease in executive compensation. Dr. Lu is also eligible to receive an annual discretionary bonus, not to exceed 50% of her base salary, if certain financial, clinical development, and/or business milestones are met in the discretion of Board of Directors. Such milestones are established annually by mutual agreement between Dr. Lu and the Board of Directors.

Dr. Lu’s employment with us is at will and may be terminated by us at any time and for any reason. On November 12, 2018, we amended our Employment Agreement with Dr. Lu. Under the terms of the Amended Employment Agreement, if we terminate Dr. Lu’s employment without cause (as defined in the Employment Agreement) or if Dr. Lu resigns her employment for good reason (as defined in the Employment Agreement), Dr. Lu will be entitled to receive the following:

| · | cash severance equal to her annual salary, paid over a period of twelve months; |

| · | payment of the premiums to continue health care coverage for Dr. Lu and her eligible dependents under COBRA for up to twelve months; |

| · | a pro rata share of her annual bonus, to be paid when and if such bonus would have been paid under the Employment Agreement; and |

| · | immediate accelerated vesting of all of her unvested equity awards, except for equity awards granted in 2019 pursuant to the SPMA. |

16

If Dr. Lu’s employment is terminated due to her death or complete disability (as defined in the Employment Agreement), she shall be entitled to receive the following:

| · | cash severance equal to her annual salary, paid over a period of ninety days; |

| · | a pro rata share of her annual bonus, to be paid when and if such bonus would have been paid under the Employment Agreement; and |

| · | immediate accelerated vesting of all of her unvested equity awards, except for equity awards granted in 2019 pursuant to the SPMA. |

Employment Agreement with Mr. Vazzano

Mr. Vazzano’s salary for 2020 and 2019 was $206,000 and $200,000, respectively. As described in our letter agreement with Mr. Vazzano, Mr. Vazzano is eligible to receive an annual bonus of up to 25% of his base salary, as determined by the Company in its discretion based upon factors including corporate and individual performance. If Mr. Vazzano’s employment is terminated by the Company without “cause” or by Mr. Vazzano following the relocation of his primary place of work to a different location that is greater than 40 miles from his home in Morristown, New Jersey, then he will be entitled to receive severance pay equal to six months’ salary, payable over a six-month period. Mr. Vazzano is eligible to participate in the Company’s employee benefit plans and programs, subject to the terms and conditions thereof.

Annual Incentive Bonus

In 2020, Dr. Lu was eligible to earn an annual bonus equal of up to 50% of her base salary plus additional compensation related to certain stretch goals. In 2020, Mr. Vazzano was eligible to earn an annual bonus equal of up to 25% of his base salary plus additional compensation related to certain stretch goals. Dr. Lu’s and Mr. Vazzano’s bonus opportunities for 2020 were based upon the Company’s performance against pre-established corporate goals and objectives, which included a combination of clinical and regulatory goals related to our product as well as other corporate goals including stretch goals and were also based on the second stage closing with InvaGen.

The corporate performance goals and objectives used to determine Dr. Lu’s and Mr. Vazzano’s bonuses for 2020 were as follows:

| · | Various clinical and regulatory goals — 95% maximum potential weighting (0% achieved); |

| · | Various goals related to corporate development — 5% maximum potential weighting (0% achieved); |

| · | Various stretch goals related to corporate development — 10% maximum potential weighting (0% achieved). |

These goals and objectives were not achieved and accordingly Dr. Lu and Mr. Vazzano were paid 0% of their target bonus amount. The actual amounts paid to the executives pursuant to their annual cash incentive awards and bonuses are reported in the “Summary Compensation Table” as “Non-equity Incentive Compensation”.

17

Equity Awards

The Compensation Committee has granted each of Dr. Lu and Mr. Vazzano the following equity awards under our 2015 Incentive Plan. In 2020, Dr. Lu received an award of 110,959 restricted stock units (“RSUs”), and Mr. Vazzano received an award of 22,727 RSUs, each of which vests as described in Footnote 7 to the Outstanding Equity Awards Table below. Under United States Generally Accepted Accounting Principles (“U.S. GAAP”), stock-based compensation for these milestone awards will be measured and recorded if and when it is probable that the milestone will be achieved, and these awards will be reported in the Summary Compensation Table at such time.

Outstanding Equity Awards at 2020 Fiscal Year End

| Name | Grant Date | Number of Shares of Units of Stock that Have Not Vested | Market

Value of Shares or Units of Stock that Have Not Vested ($)(1) | Equity Incentive Plan Awards; Number of Unearned Shares, Units or Other Rights that Have Not Vested | Equity

Incentive Plan Awards; Market Value or Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested ($)(1) | |||||||||||||||

| Lucy Lu | 6/10/2015 | - | - | 50,000 | (2) | 297,500 | ||||||||||||||

| Lucy Lu | 8/8/2017 | 215,000 | (3) | 1,279,250 | ||||||||||||||||

| Lucy Lu | 8/7/2018 | 250,000 | (5) | 1,487,500 | ||||||||||||||||

| Lucy Lu | 6/3/2019 | - | - | 135,617 | (7) | 806,921 | ||||||||||||||

| Lucy Lu | 2/12/2020 | - | - | 110,959 | (7) | 660,206 | ||||||||||||||

| Joseph Vazzano | 8/8/2017 | 7,500 | (4) | 44,625 | ||||||||||||||||

| Joseph Vazzano | 8/7/2018 | 15,000 | (6) | 89,250 | ||||||||||||||||

| Joseph Vazzano | 6/3/2019 | 27,778 | (7) | 165,279 | ||||||||||||||||

| Joseph Vazzano | 2/12/2020 | 22,727 | (7) | 135,226 | ||||||||||||||||

| (1) | The market value of unvested restricted stock awards/units was calculated by multiplying the number of units by $5.95, the closing sales price of our common stock on December 31, 2020. |

| (2) | Also Represents 166,667 restricted stock awards vesting upon achievement of goals and objectives relating to the development of IV Tramadol of which 50,000 remained unvested as of December 31, 2020. |

| (3) | Represents restricted stock units vesting as follows: 75% on the earlier of Dr. Lu’s request for the shares or August 8, 2021 and 25% on August 8, 2021. |

| (4) | Represents restricted stock units vesting annually in equal installments on August 8, 2018 – 2021. |

| (5) | Represents restricted stock units vesting as follows: 50% on the earlier of Dr. Lu’s request for the shares or August 7, 2021, 25% on August 7, 2021, and 25% on August 7, 2022. |

| (6) | Represents restricted stock units vesting annually in equal installments on August 7, 2019 – 2022. |

| (7) | Represents restricted stock units vesting upon the second stage closing with InvaGen, as defined in the SPMA, of which all remained unvested as of December 31, 2020. On November 1, 2021, the SPMA was terminated and the restricted stock units were forfeited. |

18

Potential Payments upon Termination or Change in Control

As detailed above, we have an amended employment agreement with Dr. Lu that provides certain compensation and benefits in the event of a termination of her employment or change in control under certain conditions. In addition, Dr. Lu’s amended employment agreement and our equity plan provide certain equity award benefits in connection with a termination or change in control.

Dr. Lu’s Restricted Shares

| · | If we terminate Dr. Lu’s employment without “cause” or Dr. Lu resigns for “good reason,” at any time, then all of her unvested equity awards, except for equity awards granted in 2019 and 2020 pursuant to the SPMA will become fully vested. |

| · | If Dr. Lu’s employment terminates as a result of her death or “disability,” all of her unvested equity awards, except for equity awards granted in 2019 and 2020 pursuant to the SPMA will become fully vested. |

Other Awards Granted under the 2015 Incentive Plan

| · | Unless otherwise provided in an award certificate or any special plan document governing an award, upon the occurrence of a change in control of our company, (i) all outstanding options, SARs and other awards in the nature of rights that may be exercised will become fully exercisable, (ii) all time-based vesting restrictions on outstanding awards will lapse; and (iii) the payout opportunities attainable under all outstanding performance-based awards will vest based on target performance and the awards will pay out on a pro rata basis, based on the time elapsed prior to the change in control. |

| · | The Compensation Committee may, in its discretion, accelerate the vesting and/or payment of any awards for any reason, subject to certain limitations under Section 409A of the Internal Revenue Code. The Compensation Committee may discriminate among participants or among awards in exercising such discretion. |

19

In January 2017, our directors adopted a Non-Employee Directors Compensation Plan for our non-employee directors pursuant to our 2015 Incentive Plan. Our non-employee directors currently receive the following compensation for service to the Board:

Cash Compensation:

| · | $50,000 annual retainer; |

| · | $10,000 additional annual retainer for the Executive Chairman of the Board; and |

| · | $10,000 additional annual retainer for the Audit Committee Chair. |

Equity Compensation:

| · | Initial Equity Grant: 50,000 shares of restricted stock, which shares shall vest and become non-forfeitable in equal annual installments over three years, beginning on the third (3rd) anniversary of the grant date, subject to the director’s continued service on the board of directors on such date. This grant was waived for the InvaGen appointed directors.. |

| · | Re-Election Equity Grant: The greater of (i) a number of shares of restricted stock having a fair market value on the grant date of $50,000, or (ii) 10,000 shares of restricted stock, which shares shall vest and become non-forfeitable on the third (3rd) anniversary of the grant date, subject to the director’s continued service on the board of directors on such date. This grant was waived for the InvaGen appointed directors and Dr. Rosenwald. |

| · | In 2019 and 2020, each of Mr. Herskowitz and Dr. Kranzler was granted 10,000 restricted stock awards each year which vest upon the second stage closing with InvaGen, as defined in the SPMA. Under U.S. GAAP, stock-based compensation for these milestone awards will be measured and recorded if and when it is probable that the milestone will be achieved, and these awards will be reported in the Director Compensation Table at such time. On November 1, 2021, the SPMA was terminated and the restricted stock awards were forfeited. |

In addition, each non-employee director receives reimbursement for reasonable travel expenses incurred in attending meetings of our board of directors and meetings of committees of our board of directors.

20

The following table sets forth the cash and other compensation we paid to the non-employee members of our Board of Directors for all services in all capacities during 2020.

| Name | Fees

Earned or Paid in Cash(1) | Stock Awards ($)(3) | Total ($) | |||||||||

| Lindsay A. Rosenwald | - | - | - | |||||||||

| Neil Herskowitz | 60,000 | - | 60,000 | |||||||||

| Jay Kranzler | 50,000 | - | 50,000 | |||||||||

| Jaideep Gogtay | - | - | - | |||||||||

| Thomas Moore (2) | 50,000 | - | 50,000 | |||||||||

| Elizabeth Garrett Ingram | - | - | - | |||||||||

| (1) | Represents cash retainer for serving on our Board and committees of the Board. |

| (2) | Resigned from the Board on December 31, 2020. |

| (3) | As of December 31, 2020, the aggregate number of restricted stock and restricted stock units held by each non-employee director was as follows: Dr. Rosenwald, 21,330 restricted stock awards; Mr. Herskowitz, 67,997 restricted stock awards; Dr. Kranzler, 67,997 restricted stock awards; and 0 for each of Dr. Gogtay, Mr. Moore, and Ms. Ingram. |

21

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who own more than 10% of the shares of our common stock to file an initial report of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the SEC. Such officers, directors and 10% stockholders are also required by SEC rules to furnish us with copies of any Forms 3, 4 or 5 that they file. The SEC rules require us to disclose late filings of initial reports of stock ownership and changes in stock ownership by our directors, executive officers and 10% stockholders. Based solely on a review of copies of the Forms 3, 4 and 5 furnished to us by reporting persons and any written representations furnished by certain reporting persons, we believe that during the fiscal year ended December 31, 2020, all Section 16(a) filing requirements applicable to our directors, executive officers and 10% stockholders were completed in a timely manner, except for one Form 4 filing related to two transactions (one transaction was reported in a timely manner), by Neil Herskowitz.

22

Since January 1, 2020, the Company has not been a party to any transaction in which the amount involved exceeded or will exceed $120,000, and in which any of its directors, named executive officers or beneficial owners of more than 5% of the Company’s capital stock, or an affiliate or immediate family member thereof, had or will have a direct or indirect material interest, and other than compensation, termination, and change-in-control arrangements.

The written charter of the Audit Committee authorizes, and the Nasdaq Stock Market listing rules require, the Audit Committee to review and approve related-party transactions. In reviewing related-party transactions, the Audit Committee applies the basic standard that transactions with affiliates should be made on terms no less favorable to the Company than could have been obtained from unaffiliated parties. Therefore, the Audit Committee reviews the benefits of the transactions, terms of the transactions and the terms available from unrelated third parties, as applicable. All transactions other than compensatory arrangements between the Company and its officers, directors, principal stockholders and their affiliates will be approved by the Audit Committee or a majority of the disinterested directors, and will continue to be on terms no less favorable to the Company than could be obtained from unaffiliated third parties.

The following is a summary of each transaction or series of similar transactions since the inception of Avenue to which it was or is a party and that:

| · | the amount involved exceeded or exceeds $120,000 or is greater than 1% of our total assets; and |

| · | any of our directors or executive officers, any holder of 5% of our capital stock or any member of their immediate family had or will have a direct or indirect material interest. |

Founders Agreement and Management Services Agreement with Fortress

Fortress entered into a Founders Agreement with Avenue in February 2015, pursuant to which Fortress assigned to Avenue all of its rights and interest under Fortress’s license agreement with Revogenex for IV Tramadol (the “License Agreement”). As consideration for the Founders Agreement, Avenue assumed $3.0 million in debt that Fortress accumulated for expenses and costs of forming Avenue and obtaining the IV Tramadol license. This debt was repaid to Fortress in 2017. As additional consideration for the transfer of rights under the Founders Agreement, Avenue shall also: (i) issue annually to Fortress, on the anniversary date of the Founders Agreement, shares of common stock equal to two and one half percent (2.5%) of the fully-diluted outstanding equity of Avenue at the time of issuance; (ii) pay an equity fee in shares of Avenue common stock, payable within five (5) business days of the closing of any equity or debt financing for Avenue or any of its respective subsidiaries that occurs after the effective date of the Founders Agreement and ending on the date when Fortress no longer has majority voting control in Avenue’s voting equity, equal to two and one half percent (2.5%) of the gross amount of any such equity or debt financing; and (iii) pay a cash fee equal to four and one half percent (4.5%) of Avenue’s annual net sales, payable on an annual basis, within ninety (90) days of the end of each calendar year. In the event of a change in control (as it is defined in the Founders Agreement), Fortress will be paid a one-time change in control fee equal to five (5x) times the product of (i) net sales for the twelve (12) months immediately preceding the change in control and (ii) four and one-half percent (4.5%). This additional consideration was waived on November 12, 2018 with the Waiver Agreement signed between Avenue, Fortress and InvaGen.

On September 13, 2016, we entered into an Amended and Restated the Founders Agreement, (“A&R Founders Agreement”) with Fortress. The A&R Founders Agreement eliminated the Annual Equity Fee in connection with the original agreement and added a term of 15 years, which upon expiration automatically renews for successive one-year periods unless terminated by Fortress or a Change in Control occurs. Concurrently with the A&R Founders Agreement, the Company entered into an Exchange Agreement whereby the Company exchanged Fortress’ 2.3 million Class A common shares for approximately 2.5 million common shares and 250,000 Class A Preferred shares.

23