UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. ____)

| Filed by the Registrant. | x |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

AVENUE THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

AVENUE THERAPEUTICS, INC.

1111 Kane Concourse, Suite 301

Bay Harbor Islands, Florida 33154

Dear Stockholder:

You are cordially invited to the Annual Meeting of Stockholders (the “Annual Meeting”) of Avenue Therapeutics, Inc. (“Avenue” or the “Company”), to be held virtually at 9:30 a.m. Eastern Time, on Thursday, June 22, 2023. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/ATXI2023, where you will be able to listen to the meeting live, submit questions and vote online. At the Annual Meeting, the stockholders will be asked to (i) elect six directors for a term of one year until our 2024 Annual Meeting of Stockholders or until their successors are duly elected and qualified in accordance with our Second Amended and Restated Bylaws (“Bylaws”), (ii) ratifying the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023, (iii) approve the compensation of our named executive officers, in an advisory vote, (iv) approve the frequency with which we will hold an advisory vote on the compensation of our named executive officers, in an advisory vote, and (v) transact any other business that may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting. You will also have the opportunity to ask questions at the meeting.

Your vote is important. It is important that your stock be represented at the meeting regardless of the number of shares you hold. To be sure your vote counts and assure a quorum, please vote by mobile device or over the Internet, or if you received proxy materials by mail, vote, sign, date and return the proxy card accompanying the printed proxy materials, as soon as possible, regardless of whether you plan to virtually attend the meeting; or if you hold your shares through a bank, brokerage firm or other nominee, please follow the instructions for voting provided by your bank, brokerage firm or other nominee, regardless of whether you plan to attend the Annual Meeting virtually. If you virtually attend the Annual Meeting and wish to vote virtually, you may revoke your earlier proxy by voting at the Annual Meeting.

If you have any questions about the proxy statement or the accompanying Annual Report on Form 10-K for the year ended December 31, 2022, please contact David Jin, our Interim Chief Financial Officer, Chief Operating Officer and Corporate Secretary at (781) 652-4500.

We look forward to virtually seeing you at the Annual Meeting.

Sincerely,

Alexandra MacLean, M.D.

Chief Executive Officer

April 28, 2023

Bay Harbor Islands, Florida

2

AVENUE THERAPEUTICS, INC.

1111 Kane Concourse, Suite 301

Bay Harbor Islands, Florida 33154

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Date: | Thursday, June 22, 2023 |

| Time: | 9:30 a.m. Eastern Time |

| Location: | www.virtualshareholdermeeting.com/ATXI2023 |

At the meeting, stockholders will be asked to:

| 1. | Elect six directors for a term of one year until our 2024 Annual Meeting of Stockholders or until their successors are duly elected and qualified in accordance with our Second Amended and Restated Bylaws; |

| 2. | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023; |

| 3. | Approve the compensation of our named executive officers, in an advisory vote; |

| 4. | Approve the frequency with which we will hold an advisory vote on the compensation of our named executive officers, in an advisory vote; and |

| 5. | Transact any other business that may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting. |

We will hold our Annual Meeting in virtual format only, via live audio webcast, rather than at any physical location, at the date and time specified above, instead of holding the meeting at any physical location. Only those stockholders of record as of the close of business on the record date of April 25, 2023 are entitled to vote at the Annual Meeting or any postponements or adjournments thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be available for your inspection beginning June 12, 2023, at our offices located at 1111 Kane Concourse, Suite 301, Bay Harbor Islands, Florida 33154, between the hours of 10:00 a.m. and 5:00 p.m., local time, each business day during the 10 days preceding the Annual Meeting; however, if we determine that a physical in-person inspection is not practicable, such list of stockholders may be made available electronically, upon request. You or your proxyholder may participate, vote, and examine our stockholder list at the Annual Meeting by visiting www.virtualshareholdermeeting.com/ATXI2023 and using your 16-digit control number.

Please note the technical requirements for virtual attendance at the Annual Meeting, as described in the enclosed proxy statement under the heading “Questions and Answers.”

Pursuant to rules promulgated by the Securities and Exchange Commission, we are providing access to our proxy materials over the Internet. On or about April 28, 2023, we will mail a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) to each of our stockholders of record and beneficial owners at the close of business on the record date. On the date of mailing the Internet Notice, all stockholders will have the ability to access all the proxy material on a website referred to in the Internet Notice. These proxy materials will be available free of charge.

3

YOUR VOTE IS IMPORTANT!

Submitting your proxy card or voting over the Internet does not affect your right to vote virtually if you decide to virtually attend the Annual Meeting. You are urged to submit your proxy as soon as possible, regardless of whether or not you expect to virtually attend the Annual Meeting. You may revoke your proxy at any time before it is voted at the Annual Meeting by (i) delivering written notice to our Corporate Secretary, David Jin, at our address above (so long as we receive such notice no later than the close of business on the day before the Annual Meeting), (ii) submitting a later-dated proxy card or voting over the Internet or mobile device at a later time, or (iii) virtually attending and voting at the Annual Meeting. No revocation under (i) or (ii) will be effective unless written notice or the proxy card or updated vote over the Internet or mobile device is received by our Corporate Secretary at or before the Annual Meeting, prior to your proxy being voted.

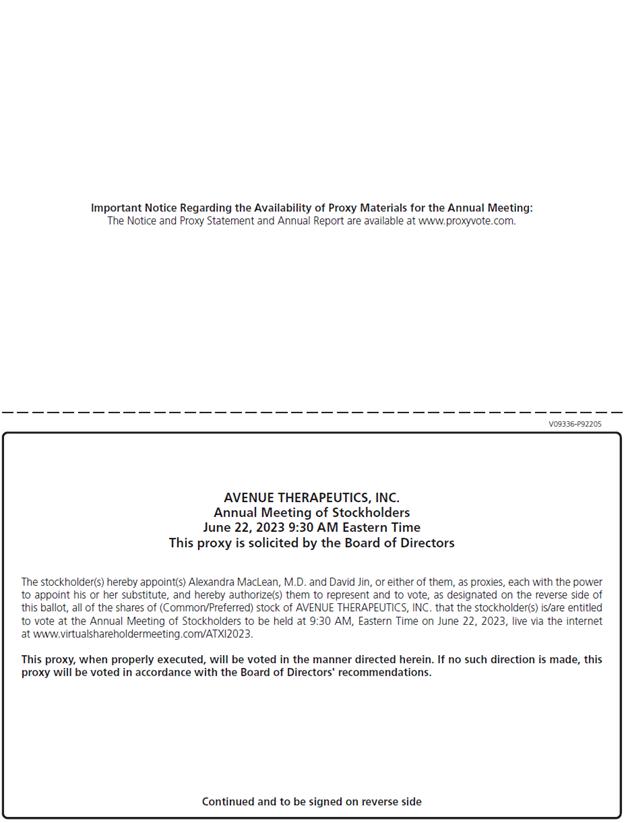

When you submit your proxy, you authorize Alexandra MacLean, M.D., our Chief Executive Officer, and David Jin, our Chief Operating Officer and Interim Chief Financial Officer, to vote your shares at the Annual Meeting and on any postponements or adjournments of the Annual Meeting in accordance with your instructions.

By Order of the Board of Directors,

David Jin

Corporate Secretary

April 28, 2023

Bay Harbor Islands, Florida

4

AVENUE THERAPEUTICS, INC.

1111 Kane Concourse, Suite 301

Bay Harbor Islands, Florida

Phone: (781) 652-4500

PROXY STATEMENT

This proxy statement is being made available via Internet access, beginning on or about April 28, 2023, to the owners of shares of common stock of Avenue Therapeutics, Inc. (the “Company,” “our,” “we,” or “Avenue”) as of April 25, 2023, in connection with the solicitation of proxies by our Board of Directors for our 2023 Annual Meeting of Stockholders (the “Annual Meeting”).

The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/ATXI2023 on Thursday, June 22, 2023, at 9:30 a.m., Eastern Time. Our Board of Directors encourages you to read this document thoroughly and take this opportunity to vote, via proxy, on the matters to be decided at the Annual Meeting. This proxy procedure is necessary to permit all stockholders, some of whom may be unable to attend the Annual Meeting virtually, to vote on the matters described in this proxy statement. As discussed below, you may revoke your proxy at any time before your shares are voted at the Annual Meeting.

5

TABLE OF CONTENTS

i

ii

| Q: | What is the purpose of the Annual Meeting? |

| A. | At the Annual Meeting, our stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders accompanying this proxy statement, including (i) the election of six directors for a term of one year until our 2024 Annual Meeting of Stockholders or until their successors are duly elected and qualified in accordance with our Second Amended and Restated Bylaws (“Bylaws”), (ii) ratifying the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023, (iii) approving the compensation of our “named executive officers” (as determined under rules of the Securities and Exchange Commission (the “SEC”)), in an advisory vote, (iv) approving the frequency with which we will hold an advisory vote on the compensation of our named executive officers, in an advisory vote, and (v) transacting any other business that may properly come before the Annual Meeting or any postponement or adjournment thereof. |

| Q: | How can I attend the Annual Meeting and why is the Company holding the Annual Meeting in a virtual only format? |

| A. | We are holding the Annual Meeting in a virtual format, rather than a meeting at any physical location, in order to encourage attendance and participation by a broader group of stockholders, while also reducing the costs and environmental impact associated with an in-person meeting. |

To attend and participate in the Annual Meeting, stockholders will need to access the live audio webcast of the meeting. To do so, stockholders of record will need to visit www.virtualshareholdermeeting.com/ATXI2023 and use their 16-digit Control Number provided in the Internet Notice to log in to this website, and beneficial owners of shares held in street name will need to follow the instructions provided by the bank, brokerage firm or other nominee that holds their shares. We encourage stockholders to log in to this website and access the webcast before the Annual Meeting’s start time. Further instructions on how to attend, participate in and vote at the Annual Meeting, including how to demonstrate your ownership of our stock as of the record date, are available at www.virtualshareholdermeeting.com/ATXI2023. Please note you will only be able to attend and vote in the meeting using this website. All references to attending the Annual Meeting “in person” in this proxy statement mean attending the live webcast at the Annual Meeting.

| Q: | How do I submit questions at the Annual Meeting? |

| A: | We are committed to engagement with our stockholders. You will be able to submit questions during our Annual Meeting by visiting www.virtualshareholdermeeting.com/ATXI2023. While we will try to answer stockholder-submitted questions that comply with the meeting rules of conduct as determined by the chair of the meeting, we may not be able to answer any or all questions due to time constraints. However, we reserve the right to edit profanity or other inappropriate language, or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If we are unable to answer the questions at the Annual Meeting, subject to Delaware law, we will reserve our answers for individual outreach following the Annual Meeting. |

| Q: | Who is entitled to vote at our Annual Meeting? |

| A: | The record holders of each of our common stock and our Class A Preferred Stock at the close of business on the record date, April 25, 2023, may vote at the Annual Meeting. Each share of common stock entitles the holder thereof to one vote on all matters submitted to stockholders and each share of Class A Preferred Stock has the voting power of 1.1 times (A) the shares of outstanding common stock plus (B) the whole shares of common stock into which the shares of outstanding Class A Preferred Stock are convertible, divided by the number of shares of outstanding Class A Preferred Stock, or 34.9 votes per share on the record date. There were 7,920,485 shares of common stock and 250,000 shares of Class A Preferred Stock outstanding on the record date and entitled to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting, including the address of and number of shares held by each stockholder of record, will be available for your inspection beginning June 12, 2023, at our offices located at 1111 Kane Concourse, Suite 301, Bay Harbor Islands, Florida 33154, between the hours of 10:00 a.m. and 5:00 p.m., local time, each business day during the 10 days preceding the Annual Meeting; however, if we determine that a physical in-person inspection is not practicable, such list of stockholders may be made available electronically, upon request. |

1

Stockholders of Record: Shares Registered in Your Name. If on the record date your shares were registered directly in your name with our transfer agent, VStock Transfer, LLC, then you are a stockholder of record. As a stockholder of record, you may vote virtually at the Annual Meeting or vote by proxy. Whether or not you plan to virtually attend the Annual Meeting, we urge you to vote over the Internet or by mobile device, or if you requested a printed copy of the proxy materials be mailed to you, fill out and return the proxy card enclosed therewith, to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Bank, Brokerage Firm, Custodian or Other Nominee. If on the record date your shares were held in an account at a brokerage firm, bank, custodian or other nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your bank, brokerage firm or other nominee on how to vote the shares in your account. You are also invited to virtually attend the Annual Meeting.

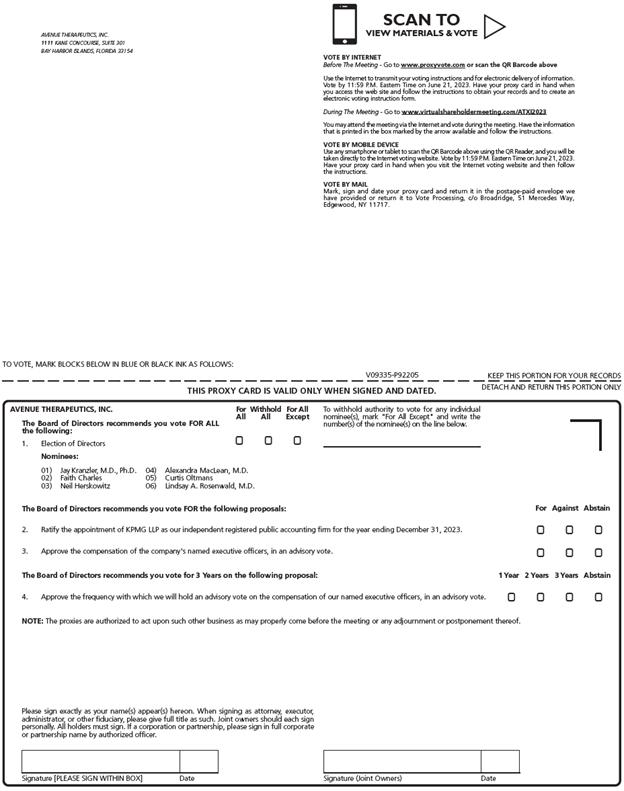

| Q: | How do I vote? |

| A: | You may vote during the Annual Meeting by following the instructions posted at www.proxyvote.com and entering your 16-digit control number included with the Internet Notice or proxy card, by use of a proxy card if you receive a printed copy of our proxy materials, or via Internet or by mobile device as indicated in the proxy card or Internet Notice. |

Whether you hold shares directly as the stockholder of record or indirectly as the beneficial owner of shares held for you by a bank, brokerage firm or other nominee (i.e., in “street name”), you may direct your vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares you hold in street name, by submitting voting instructions to your bank, brokerage firm or other nominee. In most instances, you will be able to do this by internet, mobile device or by mail. Please refer to the summary instructions below and those included on your Internet Notice, proxy card or, for shares you hold in street name, the voting instruction card provided by your bank, brokerage firm or other nominee.

| · | By Internet – If you have Internet access, you may authorize your proxy from any location in the world as directed in the Internet Notice. |

| · | By Mobile Device – If you choose to vote by mobile device, scan the QR code imprinted on the proxy card or Internet Notice using either a smartphone or tablet and you will be taken directly to the Internet Voting site. |

| · | By Mail (if you received a paper copy of the proxy materials by mail) – You may authorize your proxy by signing your proxy card and mailing it in the enclosed, postage-prepaid and addressed envelope. For shares you hold in street name, you may sign the voting instruction card included by your bank, brokerage firm or other nominee and mail it in the envelope provided. |

| Q: | What if I have technical difficulties or trouble accessing the virtual Annual Meeting? |

| A: | We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number located on the meeting page. Technical support will be available starting at approximately 9:15 a.m., Eastern Time, on June 22, 2023. |

2

| Q: | What is a proxy? |

| A: | A proxy is a person you appoint to vote your shares on your behalf. If you are unable to virtually attend the Annual Meeting, our Board of Directors is seeking your appointment of a proxy so that your shares may be voted. If you vote by proxy, you will be designating Alexandra MacLean, M.D., our Chief Executive Officer, and David Jin, our Interim Chief Financial Officer and Chief Operating Officer, as your proxies. Dr. MacLean and/or Mr. Jin may act on your behalf and have the authority to appoint a substitute to act as your proxy. |

| Q: | How will my shares be voted if I vote by proxy? |

| A: | Your proxy will be voted according to the instructions you provide. If you complete, sign and submit your proxy but do not otherwise provide instructions on how to vote your shares, your shares will be voted (i) “FOR” the six individuals nominated to serve as members of our Board of Directors, (ii) “FOR” the ratification of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023, (iii) “FOR” the approval of the compensation of our named executive officers, in an advisory vote, and (iv) “three years” as the frequency with which we will hold an advisory vote on the compensation of our named executive officers, in an advisory vote. Presently, our Board does not know of any other matter that may come before the Annual Meeting. However, your proxies are authorized to vote on your behalf, using their discretion, on any other business that properly comes before the Annual Meeting. |

| Q: | How do I revoke my proxy? |

| A: | You may revoke your proxy at any time before your shares are voted at the Annual Meeting by: |

| · | Sending a written notice that you are revoking your proxy to our Corporate Secretary, David Jin, at our address above (so long as we receive such notice no later than the close of business on the day before the Annual Meeting); |

| · | Submitting a later-dated proxy card or voting again via the Internet or mobile device; or |

| · | Virtually attending the Annual Meeting and notifying the election officials at the Annual Meeting that you wish to revoke your proxy and vote virtually. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your bank, brokerage firm or other nominee, you should follow the instructions provided by such bank, brokerage firm or other nominee.

| Q: | Is my vote confidential? |

| A: | Yes. All votes remain confidential. |

| Q: | What constitutes a quorum at the Annual Meeting? |

| A: | In accordance with Delaware law (the law under which we are incorporated) and our Bylaws, holders of a majority of the outstanding voting power of the Company, calculated in accordance with our Third Amended and Restated Certificate of Incorporation, as amended, present in person or represented by proxy, constitutes a quorum, thereby permitting the stockholders to conduct business at the Annual Meeting. Abstentions, votes withheld, and broker non-votes will be included in the calculation of the number of shares considered present at the Annual Meeting for purposes of determining the existence of a quorum. |

If a quorum is not present at the Annual Meeting, a majority of the stockholders present and by proxy may adjourn the meeting to another date. If a postponement or adjournment is for more than 30 days or a new record date is fixed for the adjourned meeting by our Board, we will provide notice of the adjourned meeting to each stockholder of record entitled to vote at the adjourned meeting. At any adjourned meeting at which a quorum is present, any business may be transacted that might have been transacted at the originally called meeting.

3

| Q: | What vote is required to elect our directors for a one-year term? |

| A: | The affirmative vote of a plurality of the votes of the shares present, virtually at the Annual Meeting or by proxy, and entitled to vote at the Annual Meeting is required for the election of each of the nominees for director. This means that the six director nominees receiving the most “FOR” votes will be elected. You are not permitted to cumulate your votes for purposes of electing directors. Because this is an uncontested election, so long as each candidate receives at least one “FOR” vote, all director nominees will be elected and votes that are withheld will have no effect on the election of the directors. Broker non-votes occur when shares are held indirectly through a bank, brokerage firm or other nominee or intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy, but does not cast a vote on a matter because the broker has not received voting instructions from the beneficial owner, and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Pursuant to the New York Stock Exchange (“NYSE”), which governs brokers’ use of discretionary authority, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner. Brokerage firms do not have authority to vote customers’ non-voted shares held by the firms in street name for the election of the directors because this proposal is not considered a “routine” matter under NYSE rules. As a result, any shares not voted by a customer will be treated as a broker non-vote and have no effect on the results of this vote. Abstentions will also have no effect on the results of this vote. Virtual attendance at our Annual Meeting will constitute presence in person for purposes of voting at the Annual Meeting. |

| Q: | What vote is required to ratify KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023? |

| A: | The affirmative vote of a majority of the shares present, virtually at the Annual Meeting or by proxy, and entitled to vote at the Annual Meeting is required to approve the ratification of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023. Abstentions will have the same effect as a vote “AGAINST” this proposal. Because this proposal is considered a routine matter under NYSE rules, discretionary votes by brokers will be counted, and there will be no broker non-votes on this proposal. |

| Q: | What vote is required to approve the approval of the compensation of our named executive officers? |

| A: | The affirmative vote of a majority of the shares present, virtually at the Annual Meeting or by proxy, and entitled to vote at the Annual Meeting is required to approve the compensation of our named executive officers. Abstentions will have the same effect as a vote “AGAINST” this proposal. Brokerage firms do not have authority to vote customers’ non-voted shares held by the firms in street name for the proposal to approve the compensation of our named executive officers because this proposal is not considered a “routine” matter under NYSE rules. As a result, any shares not voted by a customer will be treated as a broker non-vote and have no effect on the results of this vote, as they are not considered to be present and entitled to vote on this matter. |

| Q: | What vote is required to approve the frequency with which we will hold an advisory vote on the compensation of our named executive officers? |

| A: | Approval of the frequency of an advisory vote on the compensation of our named executive officers will require the affirmative vote of a majority of the votes cast at the Annual Meeting, either virtually or by proxy, assuming a quorum is present. In the event that none of the options of every one year, every two years or every three years for the frequency of the vote on the compensation of our named executive officers receives the required vote for approval, the frequency that receives the highest number of votes will be considered by our Board of Directors to be the stockholders’ preference, as expressed on an advisory basis. Abstentions will not be counted as votes for or against any particular frequency in this proposal and will have no effect on the outcome of the vote. Brokerage firms do not have authority to vote customers’ non-voted shares held by the firms in street name for the proposal to approve the frequency with which we will hold an advisory vote on the compensation of our named executive officers because this proposal is not considered a “routine” matter under NYSE rules. As a result, any shares not voted by a customer will be treated as a broker non-vote and have no effect on the results of this vote, as they are not considered to be present and entitled to vote on this matter. |

| Q: | What percentage of our outstanding common stock do our directors, executive officers, and 5% beneficial owners own? |

| A: | As of April 25, 2023, our directors, executive officers, and 5% beneficial owners collectively owned, or had the right to acquire, approximately 18.5% of our outstanding common stock and 100% of our Class A Preferred Stock. See the discussion under the heading “Stock Ownership of Our Directors, Executive Officers, and 5% Beneficial Owners” on page 24 for more details. |

4

| Q: | Who was our independent public accountant for the year ended December 31, 2022? Will this firm be represented at the Annual Meeting? |

| A: | KPMG LLP is the independent registered public accounting firm that audited our financial statements for the year ended December 31, 2022. We expect a representative of KPMG LLP to be present virtually at the Annual Meeting. The representative will have an opportunity to make a statement and will be available to answer your questions. |

| Q: | How can I obtain a copy of our Annual Report on Form 10-K? |

| A: | We have filed our Annual Report on Form 10-K for the year ended December 31, 2022 with the SEC. The Annual Report on Form 10-K is also available on the website referred to in the Internet Notice, in the “Investors” section our website at avenuetx.com and on the website of the SEC at sec.gov. You may obtain, free of charge, a copy of our Annual Report on Form 10-K, including financial statements, by writing to our Corporate Secretary, David Jin, or by email at info@avenuetx.com. Upon request, we will also furnish any exhibits to the Annual Report on Form 10-K as filed with the SEC. |

| Q: | How does the board of directors recommend that I vote my shares? |

| A: | As to the proposals to be voted on at the Annual Meeting, our board of directors unanimously recommends that you vote: |

| · | “FOR” the election to the board of directors of each of the six nominees named in Proposal No. 1; |

| · | “FOR” Proposal No. 2, the ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| · | “FOR” Proposal No. 3, the advisory approval of the compensation of our named executive officers; and |

| · | with respect to Proposal No. 4, for “THREE YEARS” as the frequency with which we will hold stockholder advisory votes on the compensation of our named executive officers. |

5

Our Bylaws provide that our Board of Directors (our “Board”) shall consist of between one to nine directors, and such number of directors within this range may be determined from time to time by resolution of our Board or our stockholders. The Board most recently set the number of directors at six members. The following individuals are being nominated to serve on our Board (See “Proposal No. 1 — Election of Directors; Nominees”):

| Name | Age | Position | Director

Since | |||

| Jay Kranzler, M.D., PhD | 65 | Chairman of the Board | 2017 | |||

| Faith Charles | 61 | Director | 2022 | |||

| Neil Herskowitz | 66 | Director | 2015 | |||

| Alexandra MacLean, M.D. | 56 | Director | 2023 | |||

| Curtis Oltmans | 59 | Director | 2021 | |||

| Lindsay A. Rosenwald, M.D. | 68 | Director | 2015 |

The Board does not have a formal policy regarding the separation of the roles of Chief Executive Officer and Chairman, as the Board believes that it is in the best interests of the Company to make that determination based on the direction of the Company and the current membership of the Board. The Board has determined that at present having Dr. Kranzler serve as Chairman and Dr. MacLean serve as our Chief Executive Officer is in the best interest of the Company’s stockholders.

Avenue has a risk management program overseen by our Chief Executive Officer and the Board. Dr. MacLean and management identify material risks and prioritize them for our Board. Our Board regularly reviews information regarding our credit, liquidity, operations, and compliance as well as the risks associated with each.

The following biographies set forth the names of our directors and director nominees, their ages, the year in which they first became directors, their positions with us, their principal occupations and employers for at least the past five years, any other directorships held by them during the past five years in companies that are subject to the reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), or any company registered as an investment company under the Investment Company Act of 1940, as well as additional information, all of which we believe sets forth each director nominee’s qualifications to serve on the Board. There is no family relationship between or among any of our executive officers or directors. There are no arrangements or understandings between any of our executive officers or directors and any other person pursuant to which any of them are elected as an officer or director.

Director Independence and Controlled Company Exemption

Avenue adheres to the corporate governance standards adopted by The Nasdaq Stock Market (“Nasdaq”). Nasdaq rules require our Board to make an affirmative determination as to the independence of each director. Consistent with these rules, our Board undertook its annual review of director independence on March 7, 2023. During the review, our Board considered relationships and transactions during 2022, 2021 and since inception between each director or any member of his or her immediate family, on the one hand, and the Company and our subsidiaries and affiliates, on the other hand. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent. Based on this review, our Board determined that Neil Herskowitz, Faith Charles, and Curtis Oltmans are independent under the criteria established by Nasdaq and our Board.

Fortress Biotech, Inc. (“Fortress”) beneficially owns capital stock representing more than 50% of the voting power of our outstanding voting stock eligible to vote in the election of directors. As a result, we qualify as a “controlled company” and avail ourselves of certain “controlled company” exemptions under the Nasdaq corporate governance rules. As a controlled company, we are not required to have a majority of “independent directors” on our Board as defined under the Nasdaq rules, or have a compensation, nominating or governance committee composed entirely of independent directors. Despite qualifying as a controlled company, our Board nevertheless is comprised of a majority of independent directors, and we have a separately constituted Compensation Committee.

6

Jay Kranzler, M.D., PhD - Chairman

Dr. Kranzler, 65, joined our Board in February 2017 and was appointed Chairman in March 2023. Dr. Kranzler has been a Founder, Chief Executive Officer, Board Member, and Advisor to leading life science companies for over 30 years. He is currently Chairman and Chief Executive Officer of Urica Therapeutics, Inc., a clinical-stage biopharmaceutical company and subsidiary of Fortress, where he has served since October 2022. He is also currently a board member of multiple private companies, including Pastorus Inc., Navitas Pharma, ImmunoBrain Checkpoint, Kore Therapeutics Ltd., and OnTrack Therapeutics Ltd., each focused on the research and experimental development of therapeutics. Dr. Kranzler started his career at McKinsey & Company where he was instrumental in establishing that firm’s pharmaceutical practice. He was a founder of Perception Neuroscience (acquired by ATAI Life Sciences) and also served as CEO of Cytel Corporation, a company focused on the development of immunomodulatory drugs. Following Cytel, Dr. Kranzler became the CEO of Cypress Bioscience, where he was credited for the development of Savella™ (milnacipran) for the treatment of fibromyalgia. Dr. Kranzler was also Vice President, Head of Worldwide External R&D Innovation and Strategic Investments at Pfizer. During his career, Dr. Kranzler has developed drugs, medical devices, as well as diagnostics, and is the inventor on multiple patents. Dr. Kranzler graduated from Yale University School of Medicine with MD and PhD degrees with a focus in psychopharmacology. We believe that Dr. Kranzler is qualified to serve on our Board due to his management experience, his service as an executive of biopharmaceutical companies and his knowledge of our business and industry.

Faith Charles

Faith L. Charles, 61, has been a corporate transactions and securities partner at the law firm of Thompson Hine, LLP since 2010. She leads Thompson Hine’s Life Sciences practice and co-heads the securities practice, advising public and emerging biotech and pharmaceutical companies in the U.S. and internationally. Ms. Charles negotiates complex private and public financing transactions, mergers and acquisitions, licensing transactions and strategic collaborations. She serves as outside counsel to a myriad of life sciences companies and is known in the industry as an astute business advisor, providing valuable insights into capital markets, corporate governance and strategic development. Since March 2021, Ms. Charles has served on the Board of Directors, Audit Committee and Nominating and Corporate Governance Committee of Abeona Therapeutics Inc. (Nasdaq: ABEO), a clinical-stage biopharmaceutical company developing cell and gene therapies for life-threatening rare genetic diseases whose common stock is listed on the Nasdaq. She has served on the Board of Directors of Amydis, Inc., a private pharmaceutical company developing compounds and tests for the early detection of Alzheimer’s and other amyloid-associated diseases, since March 2019. From 2018 until October 2021, Ms. Charles served on the Board of Directors and as a member of the Audit Committee and Chair of the Compensation Committee of Entera Bio Ltd. (Nasdaq: ENTX), a publicly-traded biotechnology company. Ms. Charles founded the Women in Bio Metro New York chapter and chaired the chapter for five years. She currently serves on the national board of Women in Bio. Ms. Charles is also a member of the board of Red Door Community (formerly Gilda’s Club New York City). She has been recognized as a Life Sciences Star by Euromoney’s LMG Life Sciences, has been named a BTI Client Service All-Star, and was named by Crain’s New York Business to the list of 2020 Notable Women in the Law. Ms. Charles holds a J.D. degree from The George Washington University Law School and a B.A. in Psychology from Barnard College, Columbia University. Ms. Charles is a graduate of Women in Bio’s Boardroom Ready Program, an Executive Education Program taught by The George Washington University School of Business. We believe that Ms. Charles is qualified to serve on our Board due to her expertise in legal matters relevant to our business, including in the life sciences industries.

Neil Herskowitz

Mr. Herskowitz, 66, joined our Board in August 2015 and has served as the Chairman of our Audit Committee since September 2016. Mr. Herskowitz has served as the managing member of the ReGen Group of companies, located in New York, since 1998, which include ReGen Capital Investments LLC and Riverside Claims Investments LLC. He has also served as the President of its affiliate, Riverside Claims LLC, since June 2004. Additionally, Mr. Herskowitz served as a Board member of National Holdings, Inc. from 2016 to 2019, and has served as a Board member of Mustang Bio, Inc. (Nasdaq: MBIO), Journey Medical Corporation (Nasdaq: DERM) and Checkpoint Therapeutics, Inc. (Nasdaq: CKPT), each of which are subsidiaries of Fortress, since 2015. Mr. Herskowitz received a B.B.A. in Finance from Bernard M. Baruch College in 1978. The Board believes, based on Mr. Herskowitz’s over 15 years of Audit Committee and Board experience in the biotech industry, that Mr. Herskowitz is qualified to serve as a member of our Board and as the Chairman of our Audit Committee.

7

Alexandra MacLean, M.D.

Dr. MacLean, 56, joined our Board in March 2023 and has served as Chief Executive Officer of the Company since August 2022. She previously served as Entrepreneur in Residence at Fortress, a biopharmaceutical company and a partner company of the Company, from November 2021 through July 2022. She previously served as General Partner and Principal at TVM Capital GmbH, an international life sciences venture capital firm, from January 2020 through October 2021; as Head of Licensing and Business Development at Imbrium Therapeutics L.P., a clinical-stage biopharmaceutical company and a subsidiary of Purdue Pharma, L.P. (“Purdue”), from January 2019 through January 2020; and in various roles at Purdue, a privately held pharmaceutical company, from 2015 to January 2019. Prior to joining Purdue, she served at Plasma Surgical, a medical device company, from 2014 to 2015, and Covidien, a medical devices and supplies manufacturer later acquired by Medtronic plc (NYSE: MDT), from 2010 to 2013. She began her career in the pharmaceutical industry at Merck & Co. (NYSE: MRK), a pharmaceutical company, where she worked from 2008 to 2010. Dr. MacLean holds an M.D. degree from Columbia University, Vagelos College of Physicians and Surgeons, an MBA from the University of Colorado – Boulder, and an M.Phil. from the University of Cambridge in History of Science. She obtained a B.Sc. in Physiology from McGill University. The Board believes, based on Dr. MacLean’s pharmaceutical industry experience and medical training, that Dr. MacLean has the appropriate set of skills to serve as a member of the Board.

Curtis Oltmans

Mr. Oltmans, 59, joined our Board in April 2021 and is currently Chief Legal Officer of Fulcrum Therapeutics, Inc. (Nasdaq: FULC), where he has served since November 2020, and has over 25 years of experience in corporate law including senior management positions in legal departments at several leading pharmaceutical and biotechnology companies. Prior to Fulcrum Therapeutics, Inc, he served as Vice President, Head of Litigation at DaVita Kidney Care, Inc. where he was responsible for all litigation, workers’ compensation and employee safety matters. Prior to DaVita Kidney Care, Mr. Oltmans was Executive Vice President, General Counsel and Corporate Secretary at Array BioPharma, Inc. (Nasdaq: ARRY), where he oversaw all legal, corporate governance, patent and compliance matters. He previously served as Corporate Vice President and General Counsel for Novo Nordisk, Inc. (NYSE: NVO), North America. He was responsible for strategic support in areas including market access, government affairs, communications and product marketing. He has also served as Assistant General Counsel for Eli Lilly and Company after beginning his legal career supporting clients in pharmaceutical and medical device litigation matters. He served on the Board of Trustees for the Mercer County Boy’s and Girl’s Club. Mr. Oltmans received a B.A. in political science from the University of Nebraska and his J.D. from the University of Nebraska College of Law. Based on Mr. Oltmans’ pharmaceutical industry experience, the Board believes that Mr. Oltmans has the appropriate set of skills to serve as a member of the Board.

Lindsay A. Rosenwald, M.D.

Dr. Rosenwald, 68, has served on our Board since inception and served as our Executive Chairman of the Board until March 2023. Dr. Rosenwald has also served as Chairman, President and Chief Executive Officer of Fortress Biotech, Inc. (Nasdaq: FBIO), the Company’s parent company, since December 2013, and as a member of Fortress’ board since October 2009. He has served as the Chairman of Journey Medical Corporation (Nasdaq: DERM), a subsidiary of Fortress, since October 2014, a director of Mustang Bio, Inc. (Nasdaq: MBIO), a subsidiary of Fortress, since March 2015, and a director of Checkpoint Therapeutics, Inc. (Nasdaq: CKPT), a subsidiary of Fortress, since March 2015. From 1991 to 2008, Dr. Rosenwald served as the Chairman of Paramount BioCapital, Inc. The Board believes that Dr. Rosenwald’s extensive experience over the last 35 years in founding, capitalizing and managing numerous public and private biopharmaceutical companies qualifies him uniquely to serve on the Company’s Board. Dr. Rosenwald received his B.S. in finance from Pennsylvania State University and his M.D. from Temple University School of Medicine.

8

Meetings

During 2022, our Board held twelve meetings and took action by unanimous written consent one time. Each regularly scheduled meeting of the Board includes an executive session of only independent directors. Each incumbent director attended at least 75% of the total number of meetings of the board of directors and the committees on which he or she served during the fiscal year ended December 31, 2022. The permanent committees established by our Board are the Audit Committee and the Compensation Committee, descriptions of which are set forth in more detail below. Our directors are expected to attend each Annual Meeting of Stockholders, and it is our expectation that all of the directors standing for election will attend this year’s Annual Meeting. Each of our directors attended the 2022 annual meeting of stockholders by teleconference. This will be our fifth Annual Meeting of Stockholders since we became a public reporting company in June 2017.

Communicating with the Board of Directors

Our Board has established a process by which stockholders can send communications to the Board. You may communicate with the Board as a group, or to specific directors, by writing to David Jin, our Corporate Secretary, at our offices located 1111 Kane Concourse, Suite 301, Bay Harbor Islands, Florida 33154. The Corporate Secretary will review all such correspondence and regularly forward to our Board a summary of all correspondence and copies of all correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board or committees thereof or that he otherwise determines requires their attention. Directors may at any time review a log of all correspondence we receive that is addressed to members of our Board and request copies of any such correspondence. Concerns relating to accounting, internal controls, or auditing matters may be communicated in this manner, or may be submitted on an anonymous basis via e-mail at BOD@avenuetx.com. These concerns will be immediately brought to the attention of our Board and handled in accordance with procedures established by our Board.

The Audit Committee currently consists of Neil Herskowitz, Curtis Oltmans, and Faith Charles. Mr. Herskowitz serves as the Chairperson of the Audit Committee.

The Audit Committee was formed on May 15, 2017 and held four meetings during the fiscal year ended December 31, 2022. The duties and responsibilities of the Audit Committee are set forth in the Charter of the Audit Committee which was recently reviewed by our Audit Committee and which is reviewed annually by our Audit Committee. A copy of the Charter of the Audit Committee is available on our website, located at www.avenuetx.com. Among other matters, the duties and responsibilities of the Audit Committee include reviewing and monitoring our financial statements and internal accounting procedures, the selection of our independent registered public accounting firm and consulting with and reviewing the services provided by our independent registered public accounting firm. Our Audit Committee has sole discretion over the retention, compensation, evaluation, and oversight of our independent registered public accounting firm.

The SEC and Nasdaq have established rules and regulations regarding the composition of audit committees and the qualifications of audit committee members. Our Board has examined the composition of our Audit Committee and the qualifications of our Audit Committee members in light of the current rules and regulations governing audit committees. Based upon this examination, our Board has determined that each member of our Audit Committee is independent and is otherwise qualified to be a member of our Audit Committee in accordance with the rules of the SEC and Nasdaq.

Additionally, the SEC requires that at least one member of the Audit Committee have a “heightened” level of financial and accounting sophistication. Such a person is known as the “audit committee financial expert” under the SEC’s rules. Our Board has determined that Neil Herskowitz is an “audit committee financial expert,” as the SEC defines that term, and is an independent member of our Board and our Audit Committee. Please see Neil Herskowitz’s biography on page 7 for a description of his relevant experience.

9

The report of the Audit Committee can be found on page 15 of this proxy statement.

The Compensation Committee was formed on May 15, 2017. The Compensation Committee held no meetings during the fiscal year ended December 31, 2022 and took action by unanimous written consent one time. The Compensation Committee currently consists of Neil Herskowitz and Curtis Oltmans, with Mr. Herskowitz serving as Chairperson. The duties and responsibilities of the Compensation Committee are set forth in the Charter of the Compensation Committee. A copy of the Charter of the Compensation Committee is available on our website, located at www.avenuetx.com, and is reviewed annually by the Compensation Committee. As discussed in its charter, among other things, the duties and responsibilities of the Compensation Committee include annually reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer, reviewing and approving, or making recommendations to our Board with respect to, the compensation of our Chief Executive Officer and our other executive officers, overseeing an the evaluation of our senior executives, and overseeing and administering our cash and equity incentive plans. The Compensation Committee applies discretion in the determination of individual executive compensation packages to ensure compliance with the Company’s compensation philosophy. The Chief Executive Officer makes recommendations to the Compensation Committee with respect to the compensation packages for officers other than herself. The Compensation Committee may delegate its authority to grant awards to certain employees, and within specified parameters under the Avenue Therapeutics, Inc. 2015 Incentive Plan (the “2015 Plan”), to a special committee consisting of one or more directors who may but need not be officers of the Company. As of the date of this proxy statement, however, the Compensation Committee had not delegated any such authority. The Board may engage a compensation consultant to conduct a review of its executive compensation programs in 2023. The Committee did not engage a compensation consultant in 2022.

Nasdaq has established rules and regulations regarding the composition of compensation committees and the qualifications of compensation committee members. As a controlled company, we are not required to have a compensation committee composed entirely of independent directors. However, our Board has examined the composition of our Compensation Committee and the qualifications of our Compensation Committee members in light of the current rules and regulations governing compensation committees. Based upon this examination, our Board has determined that each member of our Compensation Committee is independent and is otherwise qualified to be a member of our Compensation Committee in accordance with such rules.

We do not currently have a nominating committee or any other committee serving a similar function. Director nominations are approved by a vote of a majority of our independent directors as required under the Nasdaq rules and regulations. Although we do not have a written charter in place to select director nominees, our Board has adopted resolutions regarding the director nomination process. We believe that the current process in place functions effectively to select director nominees who will be valuable members of our Board.

We identify potential nominees to serve as directors through a variety of business contacts, including current executive officers, directors, community leaders and stockholders. We may, to the extent the Board deems appropriate, retain a professional search firm and other advisors to identify potential nominees.

We will also consider candidates recommended by stockholders for nomination to our Board. A stockholder who wishes to recommend a candidate for nomination to our Board must submit such recommendation to our Corporate Secretary, David Jin, at our offices located at 1111 Kane Concourse, Suite 301, Bay Harbor Islands, Florida 33154. Any recommendation must be received not less than 50 calendar days nor more than 90 calendar days before the anniversary date of the previous year’s annual meeting. All stockholder recommendations of candidates for nomination for election to our Board must be in writing and must set forth the following: (i) the candidate’s name, age, business address, and other contact information, (ii) the number of shares of common stock, par value $0.0001 per share (“Common Stock”), beneficially owned by the candidate, (iii) a complete description of the candidate’s qualifications, experience, background and affiliations, as would be required to be disclosed in the proxy statement pursuant to Schedule 14A under the Exchange Act, (iv) a sworn or certified statement by the candidate in which he or she consents to being named in the proxy statement as a nominee and to serve as director if elected, and (v) the name and address of the stockholder(s) of record making such a recommendation.

10

We believe that our Board as a whole should encompass a range of talent, skill, and expertise enabling it to provide sound guidance with respect to our operations and interests. Our independent directors evaluate all candidates to our Board by reviewing their biographical information and qualifications. If the independent directors determine that a candidate is qualified to serve on our Board, such candidate is interviewed by at least one of the independent directors and our Chief Executive Officer. Other members of the Board also have an opportunity to interview qualified candidates. The independent directors then determine, based on the background information and the information obtained in the interviews, whether to recommend to the Board that the candidate be nominated for approval by the stockholders to fill a directorship. With respect to an incumbent director whom the independent directors are considering as a potential nominee for re-election, the independent directors review and consider the incumbent director’s service during his or her term, including the number of meetings attended, level of participation, and overall contribution to the Board. The manner in which the independent directors evaluate a potential nominee will not differ based on whether the candidate is recommended by our directors or stockholders.

We consider the following qualifications, among others, when making a determination as to whether a person should be nominated to our Board: the independence of the director nominee; the nominee’s character and integrity; financial literacy; level of education and business experience, including experience relating to biopharmaceutical companies; whether the nominee has sufficient time to devote to our Board; and the nominee’s commitment to represent the long-term interests of our stockholders. We review candidates in the context of the current composition of the Board and the evolving needs of our business. We believe that each of the current members of our Board (who are also our director nominees) has the requisite business, biopharmaceutical, financial or managerial experience to serve as a member of the Board, as described above in their biographies under the heading “—Our Board of Directors.” We also believe that each of the current members of our Board has other key attributes that are important to an effective board, including integrity, high ethical standards, sound judgment, analytical skills, and the commitment to devote significant time and energy to service on the Board and its committees.

We do not have a formal policy in place with regard to diversity in considering candidates for our Board, but the Board strives to nominate candidates with a variety of backgrounds and complementary skills so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee our business. This includes diversity of experience, perspective and education, as well as individuals from other designated groups such as women, Aboriginal people, persons with disabilities and members of visible minorities (collectively, the “Designated Groups”). The Board considers the level of representation of women and other members of the Designated Groups as one of several factors in its search process.

Code of Business Conduct and Ethics

We have adopted a Code of Ethics (the “Code”), which applies to all of our directors, officers and employees. The Code includes guidelines dealing with the ethical handling of conflicts of interest, compliance with federal and state laws, financial reporting, and our proprietary information. The Code also contains procedures for dealing with and reporting violations of the Code. We have posted our Code on our website, located at www.avenuetx.com.

Policy Prohibiting Hedging and Speculative Trading

Pursuant to our Insider Trading Policy, our officers, directors, and employees are prohibited from engaging in speculative trading, including hedging transactions or short sale transactions with respect to Company securities.

11

Board Diversity

The matrix below as required by Nasdaq rules sets forth the self-identified gender identity and demographic diversity attributes of each of our directors, and the brief biographical description of the directors set forth above under the heading “—Our Board of Directors” includes the primary individual experience, qualifications, attributes, and skills of each of our directors that led to the conclusion that each director should serve as a member of our Board at this time.

Board Diversity Matrix (as of November 1, 2022)

| Total Number of Directors | 5 |

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||

| Part I: Gender Identity | ||||||||||||

| Directors | 1 | 4 | — | — | ||||||||

| Part II: Demographic Background | ||||||||||||

| White | 1 | 4 | — | — |

Board Diversity Matrix (as of April 25, 2023)

| Total Number of Directors | 6 |

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||

| Part I: Gender Identity | ||||||||||||

| Directors | 2 | 4 | — | — | ||||||||

| Part II: Demographic Background | ||||||||||||

| White | 2 | 4 | — | — |

12

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND OTHER MATTERS

KPMG LLP, the independent registered public accounting firm that audited our financial statements for the year ended December 31, 2022, has served as our independent registered public accounting firm since 2023. BDO USA, LLP (“BDO”) was the independent registered accounting firm that audited our financial statements for the year ended December 31, 2021. We expect a representative of KPMG LLP to be present at the Annual Meeting. The representative will have an opportunity to make a statement and will be available to answer your questions (see “Questions and Answers” for more information regarding submitting questions).

Our Board has asked the stockholders to ratify the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023. See “Proposal No. 2: Ratification of Appointment of KPMG LLP as Our Independent Registered Public Accounting Firm” on page 28 of this proxy statement. The Board has reviewed the fees described below and concluded that the payment of such fees is compatible with maintaining KPMG LLP’s independence. All proposed engagements of KPMG LLP and BDO, in 2022 and 2021, whether for audit services, audit-related services, tax services, or permissible non-audit services, were pre-approved by our Audit Committee.

Change in Accountant

On January 21, 2023, the Audit Committee dismissed BDO as the Company’s independent registered public accounting firm, effective immediately.

BDO’s report on the Company’s financial statements as of and for the fiscal years ended December 31, 2021 and 2020 did not contain an adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope, or accounting principles, except that the report contained an explanatory paragraph regarding the Company’s ability to continue as a going concern. During the fiscal years ended December 31, 2021 and 2020, and the subsequent interim periods through January 21, 2023, there were: (i) no disagreements within the meaning of Item 304(a)(1)(iv) of Regulation S-K and the related instructions between the Company and BDO on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to BDO’s satisfaction, would have caused BDO to make reference thereto in their reports; and (ii) no “reportable events” within the meaning of Item 304(a)(1)(v) of Regulation S-K.

Effective as of January 23, 2023, the Audit Committee engaged KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2022. During the fiscal years ended December 31, 2021 and 2020 and the subsequent interim periods through January 23, 2023, neither the Company nor anyone on its behalf has consulted with KPMG LLP regarding: (i) the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, and neither a written report nor oral advice was provided to the Company that KPMG LLP concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue; (ii) any matter that was the subject of a disagreement within the meaning of Item 304(a)(1)(iv) of Regulation S-K and the related instructions; or (iii) any reportable event within the meaning of Item 304(a)(1)(v) of Regulation S-K.

For the fiscal year ended December 31, 2022, KPMG LLP billed us an aggregate of $347,000 in fees for the professional services rendered in connection with the audit of our annual financial statements included in our Annual Report on Form 10-K for such fiscal year.

For the fiscal years ended December 31, 2022 and 2021, BDO billed us an aggregate of $230,805 and $302,550, respectively, in fees for the professional services rendered in connection with the audit of our annual financial statements included in our Annual Report on Form 10-K for such fiscal years, the reviews of our financial statements included in our Quarterly Reports on Form 10-Q during the first three fiscal quarters of the fiscal year ended December 31, 2022 and for the four fiscal quarters of the fiscal year ended December 31, 2021, and other services provided in connection with registration statements.

13

During the fiscal years ended December 31, 2022 we incurred no costs from KPMG LLP or BDO for audit-related services reasonably related to the performance of the audits and reviews for that respective fiscal year.

During the fiscal year ended December 31, 2021 we incurred no costs from KPMG LLP or BDO for audit-related services reasonably related to the performance of the audits and reviews for the respective fiscal year.

During the fiscal years ended December 31, 2022 and 2021, we were billed by KPMG LLP $21,250 and $19,580, respectively. We were not billed by BDO for those periods for any fees for professional services rendered for tax compliance, tax advice, and tax planning services.

During the fiscal years ended December 31, 2022 and 2021, we were not billed by KPMG LLP or BDO for any fees for services, other than those described above, rendered to us for those two fiscal years.

Our Audit Committee has established a policy setting forth the procedures under which services provided by our independent registered public accounting firm will be pre-approved by our Audit Committee. The potential services that might be provided by our independent registered public accounting firm fall into two categories:

| ● | Services that are permitted, including the audit of our annual financial statements, the review of our quarterly financial statements, related attestations, benefit plan audits and similar audit reports, financial and other due diligence on acquisitions, and federal, state, and non-US tax services; and |

| ● | Services that may be permitted, subject to individual pre-approval, including compliance and internal-control reviews, indirect tax services such as transfer pricing and customs and duties, and forensic auditing. |

Services that our independent registered public accounting firm are prohibited from providing include such services as bookkeeping, certain human resources services, internal audit outsourcing, and investment or investment banking advice.

All proposed engagements of our independent registered public accounting firm, whether for audit services or permissible non-audit services, are pre-approved by the Audit Committee. We jointly prepare a schedule with our independent registered public accounting firm that outlines services which we reasonably expect we will need from our independent registered public accounting firm and categorize them according to the classifications described above. Each service identified is reviewed and approved or rejected by the Audit Committee.

14

In monitoring the preparation of our financial statements, the Audit Committee met with both management and KPMG LLP, our independent registered public accounting firm for the year ended December 31, 2022, to review and discuss all audited financial statements prior to their issuance and to discuss any and all significant accounting issues. Management and our independent registered public accounting firm advised the Audit Committee that each of the financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee’s review included a discussion of the matters required to be discussed pursuant to the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC including, among other things, the following:

| ● | Methods used to account for significant or unusual transactions; |

| ● | The effect of any accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| ● | The process used by management to formulate sensitive accounting estimates and the basis for the independent registered public accounting firm’s conclusion regarding the reasonableness of any such estimates; and |

| ● | Any disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures necessary in the financial statements. |

The Audit Committee has received the written disclosures and the letter from KPMG LLP, our independent registered public accounting firm for the year ended December 31, 2022, regarding KPMG LLP’s communications with the Audit Committee concerning independence, and has discussed with KPMG LLP its independence, as required by the applicable requirements of the PCAOB.

Finally, the Audit Committee continues to monitor the scope and adequacy of our internal controls and other procedures, including any and all proposals for adequate staffing and for strengthening internal procedures and controls where appropriate and necessary.

On the basis of these reviews and discussions, the Audit Committee recommended to the Board that it approve the inclusion of our audited financial statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, for filing with the SEC.

The Audit Committee reviewed its written charter previously adopted by our Board. Following this review, the Audit Committee determined that no changes needed to be made with respect to the Audit Committee charter at this time.

| By the Audit Committee | |

| Neil Herskowitz | |

| Curtis Oltmans | |

| Faith Charles | |

| April 28, 2023 |

15

Our current executive officers are as follows:

| Name | Age | Position | ||

| Alexandra MacLean, M.D. | 56 | Chief Executive Officer | ||

| David Jin | 33 | Interim Chief Financial Officer and Chief Operating Officer |

No executive officer is related by blood, marriage or adoption to any other director or executive officer.

Alexandra MacLean, M.D. — Chief Executive Officer

See the section titled “Corporate Governance – Our Board of Directors.”

David Jin — Interim Chief Financial Officer and Chief Operating Officer

Mr. Jin has served as Interim Chief Financial Officer of the Company since May 2022 and as the Company’s Chief Operating Officer since March 2022. He previously served as the Interim Chief Executive Officer of the Company from March 2022 until August 2022. He also serves as Chief Financial Officer and Head of Corporate Development at Fortress (Nasdaq: FBIO), the Company’s parent company. Prior to Fortress, he was a member of the Private Equity group at Barings focused on control equity and asset-based investments in pharma and biotech. Before that, he was Director of Corporate Development at Sorrento Therapeutics, Inc., Vice President of Healthcare Investment Banking at FBR & Co., and began his career in management consulting at IMS Health (now IQVIA). Mr. Jin has a Bachelor of Science degree in Industrial Engineering & Management Sciences with a double-major in Mathematical Methods in the Social Sciences from Northwestern University.

16

On September 22, 2022, the Company effected a 15-for-1 reverse stock split of its issued and outstanding shares of Common Stock. As a result of the reverse split, each 15 pre-split shares of Common Stock outstanding automatically combined into one new share of Common Stock. Share amounts and prices disclosed in this proxy statement have been restated, as required, to reflect the reverse stock split as if it had occurred on January 1, 2021.

As determined in accordance with SEC rules, our “named executive officers” for purposes of this proxy statement are the four individuals set forth below. The following table sets forth information concerning compensation paid by the Company to its named executive officers for services rendered to it in all capacities during the years ended December 31, 2022, and December 31, 2021.

| Name and Principal | Stock Awards | Non-equity Incentive Plan Compensation | All Other Compensation | ||||||||||||||||||

| Position | Year | Salary ($) | Bonus ($) | ($) (1) | ($) (2) | ($) (3) | Total ($) | ||||||||||||||

| Alexandra MacLean (4) | 2022 | 153,585 | 120,000 | — | 20,000 | 6,958 | 280,542 | ||||||||||||||

| Chief Executive Officer | 2021 | — | — | — | — | — | — | ||||||||||||||

| David Jin (5) | 2022 | — | — | — | — | — | — | ||||||||||||||

| Interim Chief Financial Officer | 2021 | — | — | — | — | — | — | ||||||||||||||

| Lucy Lu (6) | 2022 | 158,659 | — | — | 400,000 | 12,200 | 570,859 | ||||||||||||||

| Former Chief Executive Officer | 2021 | 454,647 | 233,079 | 382,802 | — | 11,600 | 1,082,128 | ||||||||||||||

| Joseph Vazzano (7) | 2022 | 20,514 | — | — | — | 822 | 21,335 | ||||||||||||||

| Former Chief Financial Officer | 2021 | 255,747 | 80,513 | 93,465 | — | 11,600 | 441,325 |

| (1) | Reflects the aggregate grant date fair value of restricted stock and restricted stock units (“RSUs”) granted during the fiscal year calculated in accordance with FASB ASC Topic 718. The valuation of restricted stock and RSUs is based on our closing stock price on the grant date. |

| (2) | Reflects retention and one time sign-on bonuses. |

| (3) | Reflects employer contributions to the 401(k) retirement plan. |

| (4) | Effective August 1, 2022, Dr. MacLean was appointed Chief Executive Officer of the Company. |

| (5) | Mr. Jin served as Interim Chief Executive Officer from March 31, 2022 until August 1, 2022 and has served as Chief Operating Officer since March 21, 2022, and Interim Chief Financial Officer since May 11, 2022. |

| (6) | Dr. Lu resigned from the Company to pursue other opportunities on March 31, 2022. |

| (7) | Mr. Vazzano resigned from the Company to pursue other opportunities on January 14, 2022. |

17

Narrative to Summary Compensation Table

Employment Agreement with Dr. MacLean

As described in our letter agreement with Dr. MacLean, on August 1, 2022, the Board of Directors of the Company appointed Alexandra MacLean, M.D. to serve as the Company’s Chief Executive Officer with a salary of $332,200. The salary was increased to $400,000 in October 2022 and Dr. MacLean is eligible for an annual discretionary bonus of 30%.

Employment Agreement with Mr. Jin

Mr. Jin is employed by the Company on an at-will basis and has no written contract of employment. He currently receives no salary and would be eligible for bonus only on a discretionary basis based upon corporate factors and individual performance as determined by the Board.

Employment Agreement with Dr. Lu

On March 31, 2022, Dr. Lu resigned from the Company to pursue other opportunities. Prior to resigning, her employment agreement provided for a salary and annual discrectionary bonus and her employment with us was at will and could have been terminatated by us at anytime and for any reason. Effective March 31, 2022, we entered into a Consulting Agreement with Dr. Lu, pursuant to which she is entitled to continued vesting of any outstanding awards under the 2015 Incentive Plan while remaining a consultant to the Company.

Employment Agreement with Mr. Vazzano

On January 14, 2022, Mr. Vazzano resigned from the Company to pursue other opportunities. Prior to resigning, his employment agreement provided for a salary and annual discrectionary bonus and his employment with us was at will and could have been terminatated by us at anytime and for any reason. Effective January 15, 2022, we entered into a Consulting Agreement with Mr. Vazzano, pursuant to which he is entitled to continued vesting of any outstanding awards under the 2015 Incentive Plan while remaining a consultant to the Company.

Annual Incentive Bonus

In 2022, Dr. MacLean was eligible to earn an annual bonus of up to 30% of her base salary. Dr. MacLean’s bonus is based upon corporate factors and individual performance as determined by the Board.

In 2021, Dr. Lu was eligible to earn an annual bonus equal of up to 50% of her base salary. In 2021, Mr. Vazzano was eligible to earn an annual bonus equal of up to 25% of his base salary through June 30, 2021 and then 35% of his base salary from July 1, 2021 through December 31, 2021. Dr. Lu’s and Mr. Vazzano’s bonus opportunities for 2021 were based upon the Company’s performance against pre-established corporate goals and objectives, which included a combination of corporate, regulatory, and financial goals.

These goals and objectives were achieved at an aggregate level of 100% and accordingly Dr. Lu and Mr. Vazzano were paid 100% of their target bonus amount. The actual amounts paid to the executives pursuant to their annual cash incentive awards and bonuses are reported in the “Summary Compensation Table” as “Bonus”.

The actual amounts paid to the executives pursuant to their annual cash incentive awards and bonuses are reported in the “Summary Compensation Table” as “Bonus”.

Equity Awards

In 2022, no equity awards were issued.

18

Outstanding Equity Awards at 2022 Fiscal Year End

The following awards that were previously granted under our 2015 Plan were outstanding as of December 31, 2022:

| Name | Grant Date | Number of Shares of Units of Stock that Have Not Vested | Market Value of Shares or Units of Stock that Have Not Vested ($)(1) | Equity Incentive Plan Awards; Number of Unearned Shares, Units or Other Rights that Have Not Vested | Equity Incentive Plan Awards; Market Value or Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested ($)(1) | |||||||||||||

| Lucy Lu | 06/10/2015 | 0 | 0 | 3,333 | (2) | 3,866 | ||||||||||||

| (1) | The market value of unvested restricted stock awards/units was calculated by multiplying the number of units by $1.16, the closing sales price of our Common Stock on December 31, 2022. |

| (2) | Represents 3,333 restricted stock awards vesting upon achievement of goals and objectives relating to the development of IV Tramadol and remained unvested as of December 31, 2022. |

19

Our directors set compensation for non-employee directors on an annual basis in accordance with our 2015 Plan. Our non-employee directors received the following compensation for service to the Board during 2022:

Cash Compensation:

| ● | $50,000 annual retainer; |

| ● | $10,000 additional annual retainer for the Chairman of the Board; and |

| ● | $10,000 additional annual retainer for the Audit Committee Chair. |

Equity Compensation:

| ● | Initial Equity Grant: 50,000 shares of restricted stock, which shares shall vest and become non-forfeitable in equal annual installments over three years, beginning on the third (3rd) anniversary of the grant date, subject to the director’s continued service on the Board on such date. This grant was not issued to director Faith Charles, who was appointed in 2022. |

| ● | Re-Election Equity Grant: The greater of (i) a number of shares of restricted stock having a fair market value on the grant date of $50,000, or (ii) 10,000 shares of restricted stock, which shares shall vest and become non-forfeitable on the third (3rd) anniversary of the grant date, subject to the director’s continued service on the Board on such date. This grant was waived for Dr. Rosenwald. |

In addition, each non-employee director receives reimbursement for reasonable travel expenses incurred in attending meetings of our Board and meetings of committees of our Board.

The following table sets forth the cash and other compensation we paid to the non-employee members of our Board for all services in all capacities during 2022.

| Name | Fees Earned or Paid in Cash(1) |

Stock Awards ($)(2) |

Total ($)(3) | |||||||

| Lindsay A. Rosenwald | — | — | — | |||||||

| Neil Herskowitz | 60,000 | — | 60,000 | |||||||

| Jay Kranzler | 50,000 | — | 50,000 | |||||||

| Curtis Oltmans | 50,000 | — | 50,000 | |||||||

| Faith Charles (4) | 31,250 | — | 31,250 | |||||||

| Jaideep Gogtay (5) | — | — | — | |||||||

| Elizabeth Garrett Ingram (5) | — | — | — | |||||||

| (1) | Represents cash retainer for serving on our Board and committees of the Board, as applicable. | |

| (2) | Reflects the aggregate grant date fair value of restricted stock granted during the fiscal year calculated in accordance with FASB ASC Topic 718. The valuation of restricted stock awards is based on our closing stock price on the grant date. | |

| (3) | As of December 31, 2022, the aggregate number of restricted stock and RSUs issued to each non-employee director that remains unvested was as follows: Mr. Herskowitz, 3,268 restricted stock awards; Dr. Kranzler, 3,268 restricted stock awards; and Mr. Oltmans, 3,268 restricted stock awards. | |

| (4) | Ms. Charles was appointed to the Board and to the Audit Committee on May 16, 2022. | |

| (5) | Dr. Gogtay and Ms. Ingram resigned as of October 31, 2022. |

20