UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| x | Definitive Additional Materials | |

| ¨ | Soliciting Material under Rule 14a-12 | |

Avenue Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) |

Title of each class of securities to which transaction applies:

| |||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

| (5) |

Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount Previously Paid:

| |||

| (2) |

Form, Schedule or Registration Statement No.:

| |||

| (3) |

Filing Party:

| |||

| (4) |

Date Filed:

| |||

Avenue Therapeutics, Inc.

2 Gansevoort Street, 9th Floor

New York, New York 10014

www.avenuetx.com

SUPPLEMENT TO THE PROXY STATEMENT

FOR THE 2019 SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON FEBRUARY 6, 2019

The following information supplements the proxy statement (the “Proxy Statement”) of Avenue Therapeutics, Inc. (“Avenue,” “we,” “us” or “our”) furnished to the stockholders of Avenue in connection with the solicitation of proxies by the Board of Directors of Avenue (the “Board”) for the special meeting of the stockholders of Avenue related to our proposal to adopt the Stock Purchase and Merger Agreement (the “SPMA”) providing for the acquisition of Avenue by InvaGen Pharmaceuticals, Inc. through a two-stage transaction described in the Proxy Statement and for any adjournment or postponement thereof (the “Special Meeting”).

The Special Meeting is scheduled to be held on Wednesday, February 6, 2019, at 10:00 a.m. (Eastern Time), at the offices of our legal counsel, Alston & Bird LLP, located at 90 Park Avenue, New York, New York 10016. This supplement to the Proxy Statement (this “Supplement”) is being filed with the Securities and Exchange Commission (the “SEC”) on January 25, 2019. Capitalized terms used in this Supplement and not otherwise defined have the meaning given to such terms in the Proxy Statement.

This Supplement will be made available to stockholders at www.proxyvote.com, in the Investors' section of the Company’s website at www.avenuetx.com under "Investors / Financial Information / SEC Filings" and on EDGAR at www.sec.gov. This Supplement does not provide all of the information which is important to your decision at the Special Meeting. Important information is contained in the Proxy Statement which was previously made available to our stockholders. We encourage you to carefully read this Supplement together with the Proxy Statement.

THE PROXY STATEMENT CONTAINS IMPORTANT ADDITIONAL INFORMATION AND THIS SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT.

Only stockholders of record on the close of business on December 13, 2018 are entitled to receive notice of and to vote at the Special Meeting.

Voting Matters

We will not make available or distribute, and you do not need to submit, a new proxy card or provide new voting instructions solely as a result of this supplement. If you have already submitted your proxy or provided voting instructions, you do not need to take any action unless you wish to change your vote. Proxies returned by stockholders will remain valid and will be voted at the Special Meeting unless revoked. If you have not yet submitted your proxy or provided your voting instructions, please complete the proxy card.

The agenda items presented in the Notice and Proxy Statement are not are affected by this Supplement, and shares represented by proxies returned before the Special Meeting will be voted as instructed by the stockholder granting the proxy with respect to all other matters properly brought before the Special Meeting.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Special Meeting, we urge you to cast your vote and submit your proxy in advance of the meeting by one of the methods described in the Notice and Proxy Statement.

The Board continues to recommend that you vote “FOR” approval of the proposal to adopt the SPMA as described in the Proxy Statement.

In connection with the Stock Purchase Transaction and the Merger Transaction, two putative class action lawsuits were filed in the United States District Court for the District of Delaware. The two lawsuits are captioned Bushansky v. Avenue Therapeutics, Inc. et al, Docket No. 1:19-cv-00085 (D. Del. Jan 15, 2019) and Krause v. Avenue Therapeutics, Inc. et al, Docket No. 1:19-cv-00107 (D. Del. Jan 17, 2019) (collectively, the “Merger Litigation”). The complaints, which were filed by purported Company stockholders, generally allege that the preliminary and definitive proxy statements that the Company filed with the SEC on December 11, 2018 and December 21, 2018, respectively, omitted certain material information in connection with the Stock Purchase Transaction and the Merger Transaction in violation of Sections 14(a) and 20(a) of the Securities Exchange Act of 1934, and SEC Rule 14a-9 thereunder. These complaints include demands for, among other things, an order enjoining defendants from closing the Stock Purchase Transaction and the Merger Transaction absent certain disclosures of information identified in the complaints.

The Company believes that the claims asserted in the Merger Litigation are without merit and that no supplemental disclosure is required under applicable law. However, in order to avoid the risk of the Merger Litigation delaying or adversely affecting the Stock Purchase Transaction and the Merger Transaction and to minimize the costs, risks and uncertainties inherent in litigation, and without admitting any liability or wrongdoing, the Company has determined to voluntarily supplement the Proxy Statement it filed with the SEC on December 21, 2018. Nothing in this Supplement shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, the Company specifically denies all allegations in the Merger Litigation that any additional disclosure was or is required.

Supplemental Disclosures

These supplemental disclosures should be read in conjunction with the Proxy Statement, which in turn should be read in its entirety.

The following disclosure amends and restates the fourth paragraph in the subsection captioned "The Stock Purchase Transaction and the Merger Transaction" on page 23 of the Proxy Statement in its entirety.

On May 31, 2018, the Company then engaged Torreya to explore both royalty funds and potential partnerships. This engagement led to the Company meeting or conducting calls with interested royalty fund and potential partnership parties throughout the summer of 2018. In all, 22 potential partners evaluated the Company. Parent made an initial indication of intent at the end of July 2018. The Company received two additional indications of intent from two other interested parties in August 2018, which were less than the indication of interest made by Parent. Ultimately the Company determined that the two additional indications of interest did not provide adequate value to its stockholders and did not move forward with such parties.

The following disclosure supplements the paragraph immediately above the subsection captioned "Selected Companies Analysis" on page 32 of the Proxy Statement.

The range of implied values of the future contingent cash payments projected to be paid pursuant to the CVR following the closing of the Merger Transaction until December 31, 2036 (using financial forecasts and estimates prepared by the management of Avenue) on a net present value basis (applying discount rates ranging from 21.1% to 23.1%) was approximately $61.4 million to $74.1 million as of the closing of the Merger Transaction (assumed to occur on April 1, 2021 per the management of Avenue) and approximately $38.8 million to $48.6 million as of December 31, 2018.

The following disclosure supplements the subsection captioned "Discounted Free Cash Flow to Equity Analysis" on page 33 of the Proxy Statement.

Free cash flow to equity for Avenue can be calculated as EBITDA, less cash taxes, less capital expenditures, less change in net working capital, less interest expense, plus proceeds from future equity financing transactions needed to fund projected cash shortfalls.

The following disclosure supplements the subsection captioned "Miscellaneous" on page 33 of the Proxy Statement.

In connection with the initial public offering of Avenue in 2017 for which Oppenheimer acted as sole book-running manager, Oppenheimer received an aggregate fee, including underwriting discounts, of $500,000 from Avenue. Oppenheimer also currently serves as an agent for the at-the-market program of Mustang Bio, Inc. (“Mustang”), a subsidiary of Fortress, for which Oppenheimer could receive a fee of up to 3% of the gross proceeds of any placement. During the two years preceding the date of Oppenheimer’s opinion, Oppenheimer did not provide investment banking services to InvaGen for which it received fees.

The following disclosure supplements the subsection captioned "Fees and Expenses" on page 41 of the Proxy Statement.

The amount under “Financial advisory fee and expenses” above is comprised of the amounts paid to Torreya and Oppenheimer, in the amount of $1,900,000 and $525,000, respectively.

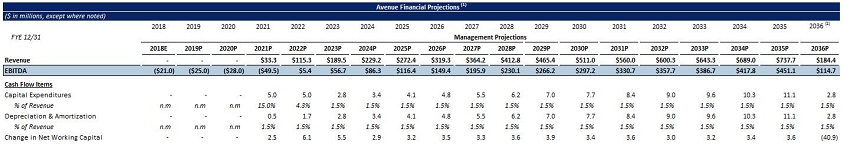

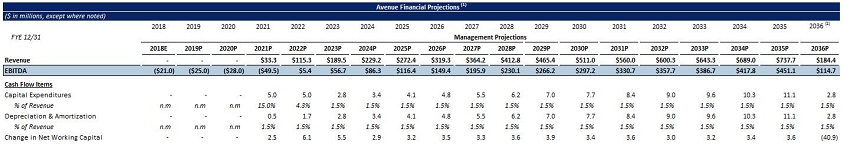

The following disclosure appears in a new section captioned "Certain Prospective Financial Information" on page 34 of the Proxy Statement prior to the section captioned "Plans for the Company After the Merger Transaction."

Certain Prospective Financial Information

Avenue does not, as a matter of course, publicly disclose forecasts or internal projections as to future performance, earnings or other results due to, among other reasons, the inherent uncertainty of the underlying assumptions and estimates. However, in connection with the proposed Merger Transaction, the senior management of Avenue provided Oppenheimer with certain nonpublic unaudited prospective financial information prepared by Avenue senior management with respect to Avenue. Such nonpublic unaudited prospective financial information of Avenue was used by Oppenheimer in performing financial analyses in connection with its opinion, as described in the Proxy Statement under the heading “Opinion of Oppenheimer & Co. Inc.” beginning on page 29. This nonpublic unaudited prospective financial information was prepared as part of Avenue’s overall process of analyzing various strategic initiatives, and was not prepared for the purposes of, or with a view toward, public disclosure or with a view toward complying with the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of prospective financial information, published guidelines of the SEC regarding forward-looking statements or GAAP. A summary of certain significant elements of this information is set forth below, and is included in the Proxy Statement solely because such information was made available to Oppenheimer in connection with the Merger Transaction. The information included below does not comprise all of the prospective financial information provided by Avenue to Oppenheimer.

Although presented with numeric specificity, the financial forecasts reflect numerous estimates and assumptions of the senior management of Avenue made at the time they were prepared. These and the other estimates and assumptions underlying the financial forecasts involve judgments with respect to, among other things, the future economic, competitive, regulatory and financial market conditions and future business decisions that may not be realized and that are inherently subject to significant business, economic, competitive and regulatory uncertainties and contingencies, including, among other things, the inherent uncertainty of the business and economic conditions affecting the industry in which Avenue operates, and the risks and uncertainties described under “Cautionary Note Regarding Forward-Looking Statements” on page 46, and in the reports that Avenue files with the SEC from time to time, all of which are difficult to predict and many of which are outside the control of Avenue. There can be no assurance that the underlying assumptions would prove to be accurate or that the projected results would be realized, and actual results likely would differ materially from those reflected in the financial forecasts, whether or not the Merger Transaction is completed. Further, these assumptions do not include all potential actions that the management of Avenue could or might have taken during these time periods.

The inclusion in the Proxy Statement of the nonpublic unaudited prospective financial information below should not be regarded as an indication that Avenue or Oppenheimer considered, or now considers, these projections and forecasts to be a necessarily accurate predictor of actual future results. The financial forecasts are not fact and should not be relied upon as being necessarily indicative of the ultimate performance of Avenue, and this information should not be relied on as such. In addition, this information represents the evaluation of the senior management of Avenue at the time it was prepared regarding certain measures of expected future financial performance. No assurances can be given that these financial forecasts and the underlying assumptions are reasonable or that, if they had been prepared as of the date of the Proxy Statement, similar assumptions would be used.

The financial forecasts summarized in this section were prepared by and are the responsibility of the senior management of Avenue. BDO USA, LLP (the independent registered public accounting firm of Avenue) has not examined, compiled or otherwise performed any procedures with respect to the prospective financial information contained in these financial forecasts and, accordingly, BDO USA, LLP has not expressed any opinion or given any other form of assurance with respect thereto and they assume no responsibility for the prospective financial information. No independent registered public accounting firm has examined, compiled or otherwise performed any procedures with respect to the prospective financial information contained in these financial forecasts and, accordingly, no independent registered public accounting firm has expressed any opinion or given any other form of assurance with respect thereto and no independent registered public accounting firm assumes any responsibility for the prospective financial information.

By including in the Proxy Statement a summary of certain financial forecasts, neither Avenue nor any of its representatives has made or makes any representation to any person regarding the ultimate performance of Avenue compared to the information contained in the financial forecasts. Avenue undertakes no obligation to update or otherwise revise the financial forecasts or financial information to reflect circumstances existing since their preparation or to reflect the occurrence of subsequent or unanticipated events, even in the event that any or all of the underlying assumptions are shown to be in error, or to reflect changes in general economic or industry conditions.

The financial forecasts summarized in this section are not being included in the Proxy Statement in order to induce any stockholder of Avenue to vote in favor any of the other proposals to be voted on at the Special Meeting.

| (1) | Financial projections provided by Avenue Management |

| (2) | 2036 Revenue and operating expenses reduced by 75% due to IP expiration and assumed generic competition |

For purposes of the financial analyses performed by Oppenheimer in connection with its opinion, Avenue also provided Oppenheimer with the SPMA Share Count and the Estimated Affected Share Count (as such terms are defined on page 32 of the Proxy Statement under the heading “Selected Companies Analysis”) of approximately 11.7 million shares and approximately 33.0 million shares, respectively.